Every parent wants to help their child as much as possible when it comes to paying for college. But many parents just can’t afford to pay for their child’s college education. If this describes you, there’s no shame in admitting it: Millions of American parents struggle to save anything for college once they’ve earmarked funds for retirement, emergency savings, and the general costs of living life. (Who would have thought that life was so expensive!)

But just because you can’t pay for your child’s college tuition doesn’t mean that you can’t help make college more affordable. Below are six ways that you can help your child pay for college even if you don’t have substantial savings. Any way that you can help lower the number of student loans your child will eventually have to pay back, and every little bit helps.

Need help keeping track of your student loans? Download our free Student Loan Spreadsheet!

1. Buy their books (or other supplies).

Attending college is an expensive prospect, and not just because of the astronomical costs of tuition and room and board. It seems that every single aspect of college comes with more fees and expenses. Between the various goods needed to furnish a dorm room, the countless fees associated with taking certain classes (lab fees, anyone?), and the downright obscene price of textbooks, many college students pay thousands of dollars on top of tuition and room and board each year.

To illustrate this point, just check out this chart by College Board which shows average college textbooks and supplies costing about $1,250 for the 2016–17 academic year.

If you can afford to cover even a fraction of your child’s total college expenses, you’ll be helping them in the grand scheme of things. Every dollar saved is a dollar that they don’t need to take out in loans. And the less debt they have, the less they’ll be paying in interest over the life of their loans. If you can swing it, consider covering their textbooks or other fees and supply expenses—just don’t put the expenses on credit cards, which carry high interest rates.

2. Let them live at home.

If you look at that same chart by College Board above, you’ll see that the average cost of room and board for the 2016-2017 school year ranged from $8,060 at public two-year universities to $11,890 at private nonprofit four-year universities. That means that 2-year degree holders are paying $16,120 for room and board ($8,060 x 2) and 4-year degree holders at private universities are paying a whopping $47,560.

Just to live at college! (And this, of course, doesn’t take into account future price increases).

If you can afford to let your child continue living at home while they attend college, then you could help them save a lot of money over the course of their degree. Even if you charge them a nominal rent, it is likely nowhere near what they’d be paying to live on campus. All of that savings translates into fewer student loans, less interest, and more money in the pockets of your kids’ future selves.

3. Cosign your child’s student loans.

Okay, before I suggest this I just want to say: Cosigning a loan of any kind of a major commitment. By cosigning a loan, you are essentially putting yourself on the hook if your child ever can’t (or just doesn’t) make their loan payments. On top of that, cosigning loans can have major impact on your credit score and your own long-term financial goals.

That being said, as long as you are certain your child will be responsible in paying them back (don’t laugh—some aren’t!), then consider cosigning their student loans to help them qualify for lower interest rates. This is especially important if your child is dependent on private student loans, which are much more expensive than federal student loans, and which will usually require a cosigner.

Just know that you will be on the line if your child fails to repay, and this could affect your relationship with your child. If you have any reservations at all, you may just want to steer clear. No judgment!

4. Take out a Parent PLUS Loan.

Okay, I just want to say that I am loathed to be suggesting that you take out student loans to help your child pay for college. After all, this site is about crushing student debt, not taking on even more.

But let’s say that your child qualifies for some federal loans, but not enough to fully cover the cost of college. If left entirely on their own, they would probably need to seek private student loans to cover the remainder of the cost, which are notoriously expensive. Private student loans can top 10 percent, sometimes more depending on your child’s credit history (or lack thereof).

An alternative to private student loans could be that you take out a Parent PLUS Loan to help your child pay for college. To put into perspective how these loans compare to private student loans: A Parent Plus Loans for 2017 has an interest rate of 7 percent. That might be more expensive than a federal loan made directly to your child, but it’s still a huge discount compared to private loans!

If you don’t have any savings, but want to help your child pay for college, applying for a Parent PLUS Loan could be just enough to fill in any funding gaps.

And keep in mind, your child can always help you pay back the loan. Many families do this; heck, my family did this. Because I did not qualify for enough student loans to fully cover the cost of my college education, my parents took out Parent PLUS Loans in their name. Then, once I graduated, I began making payments on those loans. It was better than the alternative—private student loans which, at that time, could reach upwards of 12 or 13 percent!

5. Live in a state that offers free college tuition.

Okay, so this is something that takes a little forethought, and isn’t something that most families can just decide to do on a whim. There are a lot of factors to take into consideration: Cost of living, family and friends, being able to find a job, etc. But if you can swing it, moving to a state that would offer your child free college tuition is a great way to help them afford college even if you can’t pay.

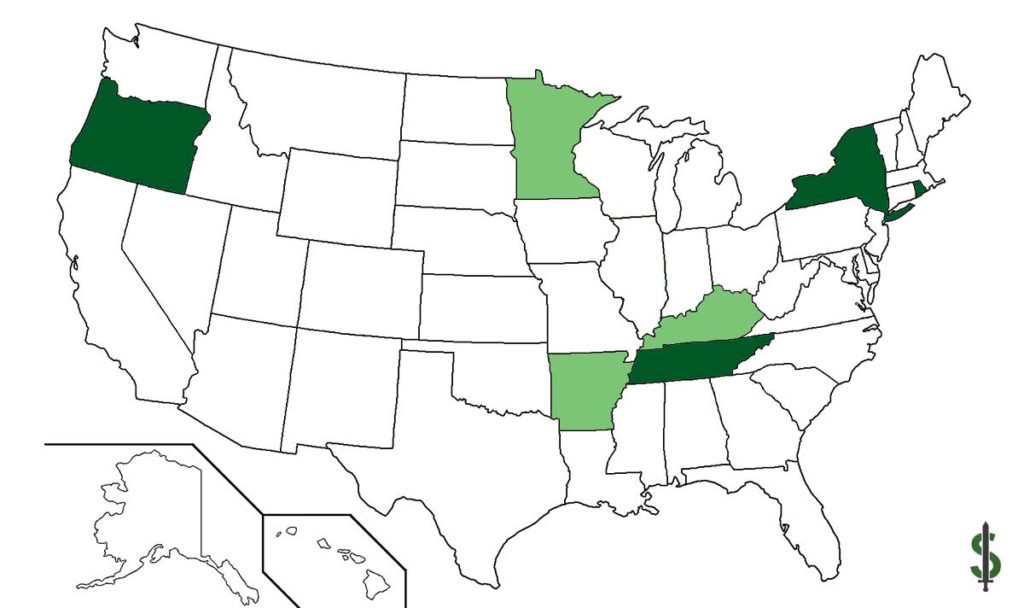

As of August 2017, four states offer free tuition: New York, Oregon, Rhode Island, and Tennessee (dark green in the map above) and three additional states have watered down versions: Arkansas, Kentucky, and Minnesota (light green in the map above). Hopefully, that number will continue to grow. Eligibility requirements to receive the funds vary from state to state, but most only require that a recipient lives in a state for one year prior to receiving the funds, meaning that there is plenty of time to move if you think that that is ultimately the right idea for your family.

6. Vote with purpose.

If you don’t live in a state with free college tuition, and don’t plan on/don’t want to move, you can do your part in making college affordable for your children and for all children by exercising your right to vote, and by using that right to vote for state and federal officials who will work to bring about state-level and federal-level programs to make college affordable for all.

7. Help them build an emergency fund.

Having a healthy emergency fund to turn to when an emergency strikes is important for everybody. It’s especially important for college students who are away from home for the first time in their lives. If you can’t afford to help your child pay for their college tuition but do have a bit of extra space in your budget, consider helping them build their first emergency fund. Even a few hundred dollars can go a long way in helping your child understand the importance of having money set aside for emergencies and inspire them to add to the fund even while they pay off their student loans—a smart move for all involved, and a better idea than helping them open a so-called “emergency credit card.”

Covering All the Bases

Not being able to help their children pay for the cost of college is often one of the most difficult things for a parent to have to admit, but there’s no shame in acknowledging your limitations. If you don’t have any college savings and can’t cover tuition, consider these six options to help your child afford college. Your kids will appreciate any little bit that you can help.

While you’re at it, encourage your child to trim their college expenses as much as possible so that they need fewer student loans to begin with, and to keep track of their student loans as they take out new ones. They’ll thank you later!

I just have the best parents who help me with everything but they know the boundaries. They don’t spoil me, they let me provide for myself, but they are always willing to help me if I fail. So I pay my own rent, a dorm room, but when I was out of work for a while, they helped me financially.

It’s great to have parents who help! Paying for tuition is very difficult, and without parental savings, it can sometimes be impossible.