When it comes time to finally send your teenager off to college, it’s only natural for you to want to make sure that they’re prepared for anything that life might throw at them, especially if this is the first time that they will be away from home.

It’s for this reason that many parents wonder: Should my child have a credit card before they go off to school?

If they’re used responsibly, credit cards can be incredibly powerful tools for anyone—including college students—helping your child build good credit, access money during emergencies, and even earn valuable rewards.

But credit cards can be incredibly destructive if you use them without understanding how they work, or if you don’t manage your debt responsibly. That’s a real risk for college students, who tend to be financially on their own for the first time in their lives during their college years. After all, how many seventeen-year-olds do you know that can accurately explain the risks of compound interest? Not many, I’d wager.

So, whether I hear the parent of a college student say that they’re thinking about helping their child sign up for a credit card or it comes from the college students themselves, my first reaction is to always ask this question: Why do you think a credit card is needed?

The answer to this question typically informs a lot of the rest of the conversation.

1. You think they need one to start building credit.

The length of your credit history is one of the most important factors that lenders use to determine your credit score. It’s natural, then, that many parents think that their child needs to open a credit card as soon as possible so that they can begin building their credit.

But if this is the only reason you’re thinking about a credit card for your child, you have other options. For example, if your child is leveraging student loans to pay for college and these loans are in their name (even if you are a cosigner) then they are already building their credit history. Similarly, any recurring bill that is in your child’s name can help them begin building their credit history, from a car insurance bill to a monthly phone, rent, or another utility bill.

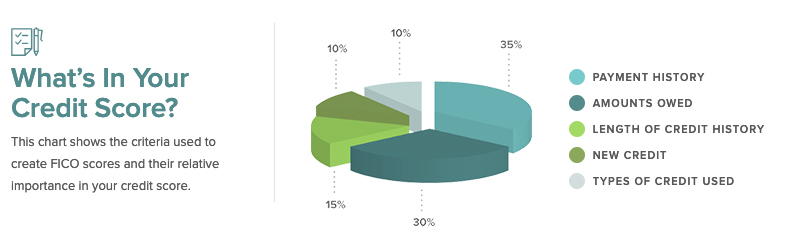

And remember, there are a lot of other factors that go into determining someone’s credit score beside the length of their credit history. Your payment history and total credit utilization rate are also extremely important, as are other factors like the different types of debt you carry and more.

If you and your child do still opt to sign up for a credit card, remember to make sure that the bill is paid in full every month to avoid interest charges. It is a myth that you need to carry a balance from month to month in order to build a credit history; simply having an active account is all that you need.

2. You want them to have one in case of emergencies.

If your child is planning to live on campus—especially if they’re going to be attending a college or university that’s far from home—it’s understandable that you might be nervous about the fact that they won’t be under your watchful eye anymore.

That’s one reason that many parents choose to open a joint credit card with their child. You want them to have access to money in the event of an emergency like a surprise flat tire, chipped tooth, or broken pair of glasses—maybe even an Uber ride home from a party when the designated driver changes his mind.

But while it’s true that credit cards can come in handy in emergency situations, the truth is that nobody should be dependent on credit cards to get through an emergency. If your child does find themselves relying on a credit card to pay for an emergency and they’re unable to pay off the balance before the billing cycle ends, they’ll just find themselves in an even deeper hole once interest payments start to kick in.

According to a survey recently conducted by Nerdwallet, the average US household carries nearly $7,000 in revolving credit card debt, costing them more than $1,000 in interest payments every year. Interest rates tend to be so high, that nearly 10% of those with credit card debt don’t believe they’ll ever be able to pay it off.

Is that really a lesson you want your child to learn in their college years?

Instead of encouraging your child to turn to credit cards to cover an emergency, teach them that emergencies are impossible to avoid forever, and that the best bet is to prepare for them by building an emergency fund. You can even help them start their own by helping them choose the right kind of account and seeding it with a couple hundred dollars that they can turn to in case something goes wrong.

Not only does this make more financial sense for everyone involved—it’ll also help you teach your child important financial skills and habits around the idea of saving instead of relying on credit, which your child will use throughout the rest of their life.

3. They want one for the rewards.

Sometimes, a child will be the one to bring up the idea of opening a credit card with their parents, not because they’re concerned about their credit score or being covered in case of an emergency, but because they heard about a really great rewards program and they’re eager to cash in. After all, who doesn’t like free money?

While it’s true that some people earn a lot of really great rewards by leveraging their credit cards, the truth is that points, rewards, miles, and cash back are never truly free. Credit card companies offer rewards not out of the kindness of their hearts, but to encourage you to sign up and spend money using their card so that they can make more money.

Between the annual fees charged by most rewards cards that can go as high as $500 and the interchange fees that credit card companies charge retailers to process their payment (which, ultimately, is passed on to you in the form of higher prices), most of us would just be better off saving for our own flights or concert tickets.

And that’s not even taking into account the impact of interest! As of February 2019, the average credit card comes with an interest rate of more than 17.5%. If you rack up a high balance on your card to earn rewards and then go even just one month without paying off the balance in full, it’s very possible that the interest you’re charged will erase any value those rewards might hold.

That’s a win for the credit card company, but a clear loss for you. While it might be difficult to convince your child that the deal they’re being offered isn’t really so much of a deal after all, it’s a very important lesson for them to learn—before they find themselves saddled in credit card debt.

Helping Your Child Develop a Healthy Relationship with Credit

Despite the risks, it is important to note that credit cards (and credit in general) can be incredibly helpful tools if they are used correctly. Though many of us would prefer to live our lives without relying on credit and debt, for the vast majority of us, that just isn’t possible. Between student loans, mortgages, credit cards, and other forms of debt, credit makes a lot of the modern world go round.

Ultimately, your decision about whether or not to introduce your child to credit cards is just that: A decision. If, in the end, you decide that you don’t want to be the one to introduce your child to a credit card, just bear in mind that that isn’t necessarily the end of the story. As soon as they are 18, they are capable of opening a card on their own. And if they don’t have experience with credit before signing up for their own card, it can be easy to get into trouble very quickly.

That’s why some credit experts recommend that parents actually introduce their children to credit before going away to college—as early as middle school, in some cases—in order to help them build a healthy relationship with credit that they can leverage throughout their lives. Exactly what this looks like can vary, but often includes first introducing a child to prepaid cards, then adding them as an authorized user on your card, and then, finally, helping them to sign up for their own account once they turn 18.

If, in the end, you decide that it still makes sense to help your child sign up for a credit card, keep these considerations in mind:

If you cosign a card, you are legally responsible to repay the debt.

Opening a joint credit account with your child can help them get a better interest rate. But don’t forget that it also makes you legally responsible for paying back any purchase made with that card, even if your child racks up charges without your knowledge. If you are worried about your child’s ability to control their spending, you may want to think twice before you cosign a card with them. If they are at least 18 years old, though, they can sign up for their own card, and you can (and should) help guide them towards a favorable card.

Opt for a lower line of credit.

If this is your child’s first experience managing their finances, opt for a credit card with a low credit limit. (Somewhere in the $300 to $500 range is common for starter cards.) This will give them some freedom to start leveraging their credit while limiting the damage that can be done if something goes wrong.

That being said, Nathan Grant, a credit industry analyst over at Credit Card Insider, does warn that, “While opting for a beginner credit card with a low credit limit can be a wise move, it could lead to high utilization rate” if a child isn’t careful. “Utilization is the second most important factor of an individual’s FICO scores, and carrying a high balance in comparison to the card’s low limit could damage your child’s scores if they’re not paying down their balance 100% of the time.”

So, as with everything else involved with credit, it all comes down to balance.

Keep fees in mind.

When it comes to credit cards, everyone always thinks about the interest rate, and with good reason. But while it’s obvious that you should opt for whatever card offers you the lowest rate, it’s also important to think about other, sometimes hidden, fees. While cards with annual fees can come with some nice perks, the truth is, most college students won’t use their cards enough to truly take advantage of these benefits. It’s smarter just to avoid them entirely.

Consider a secured card.

Secured credit cards are specifically designed to help people without credit build credit, making them perfect for college students. Typically, when you open a secured line of credit, you do so by putting down a cash deposit, which will typically match your credit limit. Secured cards are used just like regular credit cards, but the cash deposit is there in case you were to fail to make your payments.

I think it can teach responsibility. My parents let me have a credit card, and I don’t spend money unnecessarily because I understand how it works.

I realize that there are irresponsible teenagers who use the money they receive without purpose, not realizing that they need to pay it back. But maybe that’s the way to be responsible, too.