This post may include affiliate links. Please read the disclosure at the bottom of our “About” page to learn more about our affiliate program.

If you’re anything like me, then you’re always on the lookout for ways to get the most out of your money. You want to save more, spend smarter, and not have to waste a lot of time or effort to do so.

Sound like you? Then Simple may be worth looking into.

1. What is Simple and what does it do?

2. How does Simple work?

3. Fees

4. Does Simple pay interest?

5. How to open a Simple account

6. Features: Expenses, Goals, Safe-to-Spend, Referrals

7. Simple Shared

8. Our review

9. The Bottom Line

Editor’s Note: Simple takes security pretty seriously, so it was actually impossible for me to get any screenshot of the app; the software doesn’t allow it. Where possible, I have taken screenshots of the online platform to illustrate certain points. Any images of the phone app were taken directly from Simple’s website.

What is Simple and what does it do?

Simple is a banking software and app that was founded in 2009 with an aim to make banking more transparent, less confusing, and fairer for consumers (which is, presumably, how they got their name). It achieves this goal in a number of ways, largely:

- By providing customers with an online and app-based banking experience

- By refusing to charge its users any fees

- By supplying a range of features that make it easier for users to budget, save for goals, and become spend their money smarter

In this way, Simple is a lot like other personal finance apps that have recently begun to compete with larger financial companies. Acorns and Stash allow newbies to start investing; Mint and Personal Capital help people budget; Simple and Ally are online banking alternatives.

I use Simple, and I personally love it a lot. Its features are great, it’s incredibly easy to use, the company is transparent, and I save money by never paying fees. What’s not to love about that?

That being said, before we begin, I do want to spell out the fact that if you read this article, click on the link that I provide to sign up for Simple, and do actually sign up for the service, I earn a little bit of money. Specifically, I earn $20 once you make your first purchase through Simple. But so do you! This might seem like it’s incentive for me to talk up the app just to get people to sign up, but that’s honestly not the case. I wrote this article because I believe that Simple is a great company that can help my readers get more out of their banking.

How does Simple work?

Though many people refer to Simple as a bank, the truth is, they aren’t Simple is a banking software. It’s how you interact with your money. But it isn’t really a bank.

When you sign up for Simple, you are actually doing two things at once: You are creating an account to use Simple’s software (whether their online portal or their app), and you are opening a checking account with Simple’s partner bank, BBVA Compass.

BBVA Compass holds your money in an FDIC-insured checking account (which means that you’ll never have to worry about losing your money, as long as you have $250,000 or less in your account) and Simple provides you with the interface that you’ll use to access, spend, and save that money. In addition to gaining access to the app, you’ll also receive a Simple debit/checking card within a few weeks of opening your account

Does Simple charge fees?

No, Simply does not charge its users fees. It is a completely fee-free banking solution, making it perfect for college students and recent graduates with tight budgets, as well as for anyone who is tired of paying exorbitant fees to banks simply to use their own money.

If you create a Simple account, they will never charge you any fees. Period. This includes:

- Minimum required balance fees: You won’t be charged a fee if your account balance drops too low. It can be $0 and that would be fine.

- Monthly account maintenance fees: Unlike most larger banks, Simple does not charge monthly fees.

- Overdraft fees: If you don’t have the funds available in your Simple account, your transaction simply won’t be processed. This means you won’t have to pay costly overdraft fees.

- ACH Bank Transfer Fees: Want to transfer money into or out of your Simple account? You can do so, no fees involved.

- Account closing fee: Close your account at any time without paying a fee.

- Card replacement fee: If you lose your physical Simple card or otherwise need it replaced, there are no fees.

- ATM fees (domestic and international): If you use one of the 40,000 ATMs in the Allpoint network (which Simple is a part of) you won’t pay any fees whatsoever, to the ATM or to Simple. If you use an ATM outside of the Allpoint network, you may be charged a fee by the ATM, but Simple won’t charge you anything.

So you might be wondering: How does Simple make money if they don’t charge users fees? Simple makes money in two ways. The first way they make money is by collecting interest on the money in your account (which they split with BBVA Compass). The second way they make money is by charging retailers a processing fee anytime you use your Simple card to pay for something.

Does Simple pay interest?

Yes, any money that you have in your Simple checking account will earn interest. That being said, it is a very nominal 0.01% APY.

This is comparable to the interest rates that you’d find at most big banks like People’s United or Wells Fargo, but it is far less than you might find at other online-only banks like Ally. (Ally, another online bank that I love a lot, offers 0.10% interest on checking accounts with less than $15,000 minimum daily balance and 0.60% on accounts with more than $15,000.)

How important are these low rates? Well, that depends on which of Simple’s features you take advantage of.

If you use Simple predominantly for bill pay and as your checking account, then you’re fine: You’re most likely keeping your emergency fund and other savings in other savings accounts with higher yields. But if you make use of Simple’s “Goals” feature (more on this below) you might be short-changing yourself a bit in the interest department.

That said, Simple does from time to time offer promotions that can boost your interest rate. In October 2018, for example, anyone who started a savings goal and transferred at least $2,000 into it before the end of the month would receive an interest rate of 2.02% as long as the daily balance never dropped below $2,000. (Once the balance dropped past that point, the interest rate would revert to 0.01%.) 2% is a lot for a checking account to offer, so if you use Simple for your saving as well as your investing, you’d be smart to stay on the lookout for other promotions like this one.

How to open a Simple account

Opening a Simple account is about as easy as it gets. All you need is some basic information and about 5 minutes and you’ll be done.

First things first: You can choose to create your account online, or by using the Simple app (available for both Android and iOS). Choose how you want to open your account, and get started.

First, simple will ask you to create a username, set a password, and supply an email address for your account. You’ll also need to specify what you plan on using Simple for (whether it is making checks, making domestic or international wire transfers, or domestic or international ACH transfers).

Then you’ll need to provide Simple with the following:

- First and last name

- Physical address

- Occupation

- Source of income (salary, inheritance, company or property sale, investments, life insurance, or something else)

After that, Simple will need to collect some information to verify your identity, including your:

- Social Security Number

- Date of Birth

- Citizenship status

- Phone number

Upon submitting this final information, you’ll be sent a verification code by text. Entering that into the interface will complete your account set up.

Once your account is open, you can begin funding it either by depositing a check through their deposit interface (up to $2,000 at a time) or by linking another banking account and making a transfer.

Though you can begin using Simple’s online web portal and app immediately, it will take 2 to 3 weeks for your physical Simple debit card to be mailed to you.

Features

Once your Simple account is open, you can use it for a lot of different things. The features most unique to Simple include:

- The ability to create Expenses

- The ability to set Goals

- The Safe-to-Spend indicator

- A number of ways to make payments and transfer funds

- An ATM Finder

- And the ability to make money by referring friends

1. Simple Expenses

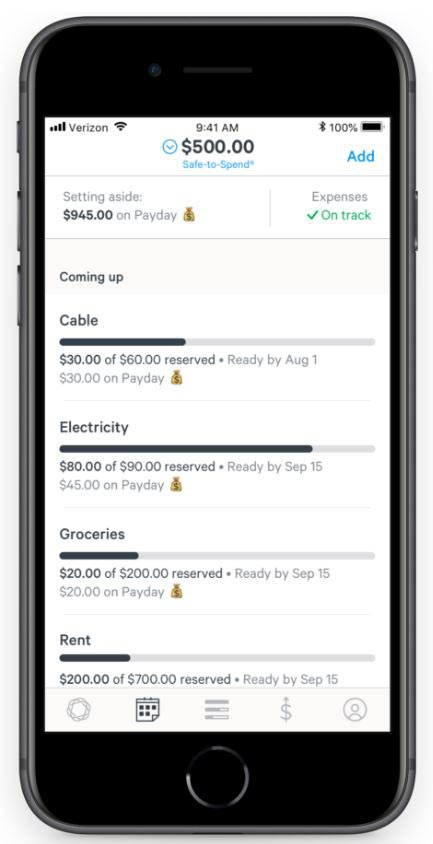

By creating an Expense in Simple, you can automatically set aside money in your budget. The goal is to help you understand how much money in your budget is “spoken for” by necessary expenses like your rent, utilities, groceries, or debt payments.

When setting up an Expense, all you need to do is:

- Name the expense, by selecting a suggested expense or adding it yourself

- Select the date that your bill is due

- Indicate how often your expense repeats: Weekly, monthly, or yearly

- Setting a budget (how much you need) to cover the expense

Once you’ve created the Expense, you can choose to either fund it manually (setting aside money on your own) or automatically. Selecting the automatic function will prompt you to choose a date that you want Simple to set aside the money for you (they suggest aligning the day with payday).

The magic of setting Expenses within Simple is two-fold. The first is that it makes it incredibly easy for users to quickly look at a complete list of all of their upcoming expenses so that it is easier to make money decisions. The second is that, by automatically earmarking those funds on payday, you’ll never accidentally spend that money again.

That’s what we call a win-win.

2. Simple Savings Goals

For a lot of people, saving money is hard. Exactly why it’s hard can be hard to pinpoint, but in many cases, it’s because we don’t do it automatically. We make saving money something that we need to think about, and when we need to think about doing something, all too often we choose not to do it.

Simple’s Goals feature aims to take the thinking out of saving money by making it automatic. Once you’ve set up a Goal, Simple will automatically move money out of your general slush fund and set it aside for your specific savings goals—either all at once, or a little bit here and there until your goal is met.

To set a goal, you can either create your own or choose from one of their suggested options. All you need to do is:

- Name your goal

- Select how much money you need to reach your Goal

- Select a day that you need it by

- Select how often you want to contribute to the Goal

Once your Goal is created, and you’ve funded it, you can set rules for when you want money to be spent from this Goal “bucket” instead of from your general fund (if you want to spend it at all).

The best part? Goals with at least $2,000 in them will earn a very healthy 2.02% interest. The worst part? Goals with less than $2,000 in them will only earn 0.01% interest, which is what you’d typically expect from a checking account.

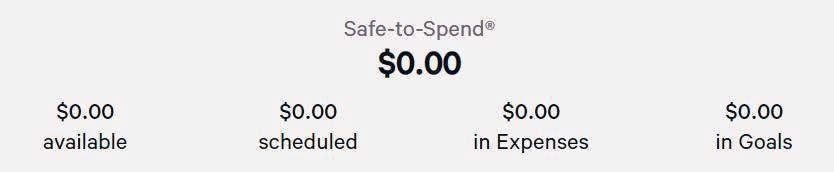

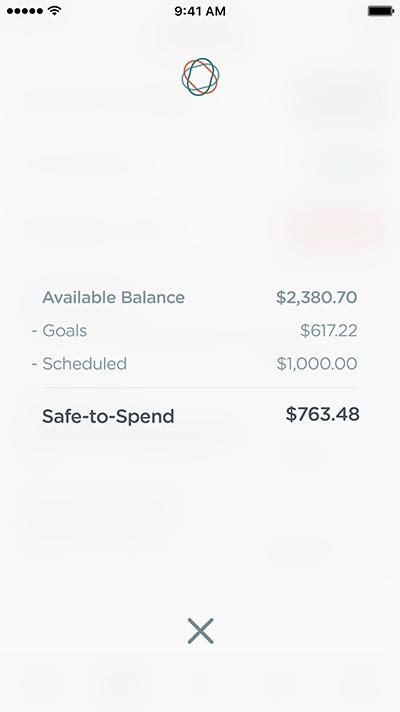

3. Safe-to-Spend Indicator

As soon as you log into your Simple account, whether online or through the app, you’ll be greeted with a couple of numbers. Safe-to-Spend is the most exciting of these numbers.

Safe-to-Spend is literally the amount of money in your Simple account that you can safely spend without messing up your budget.

Simple figures this out by taking your available balance and subtracting any scheduled transfers, any scheduled Expenses, and any scheduled Goals. The amount left over is what you can safely spend.

Is this an essential feature for a bank to offer? Absolutely not. But it certainly makes it a lot easier for you to simply open up a single app and see how much money you can spend on a night out with friends, or when shopping for a new outfit or anything else that you might want to purchase.

Spending smarter is spending better.

4. Payments and Transfers

Need to make a transfer between accounts? Simple gives users five different options to choose from:

- Instant transfer: If you are transferring funds between your own Simple account and another Simple account, the transfer will only take seconds to complete.

- External transfer: If you need to transfer money to Simple from an outside bank, or from Simple to an outside bank, it’s easy to link accounts. These transfers can take between 3 and 5 business days to complete.

- Mail a check: If you prefer to use paper checks (perhaps to pay bills and leave a paper trail) you can request Simple print and send a paper check to your contact, free of charge. This may take up to 5 business days to complete.

- Pay a bill: By signing up for bill pay through Simple, you can pay monthly or one-time bills for free right from within the app

- Deposit a check: Like most banking apps today, you can deposit a check to your Simple account directly through the app (up to $2,000 at a time). All you’ll need to do is specify the amount of the check and snap a photo of the front and back of the check and voila. Clearance can take 3 to 5 business days.

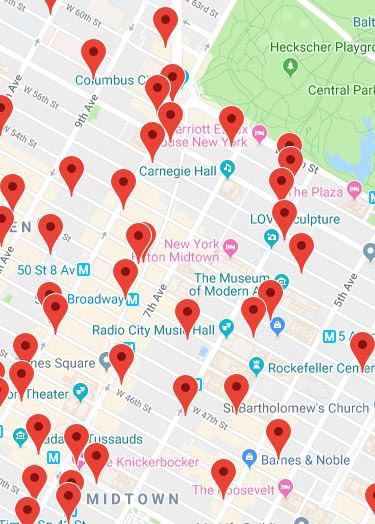

5. ATM Finder

Opening up Simple’s ATM finder will allow you to instantly find the nearest ATM that is a part of the Allpoint ATM network, helping you avoid unnecessary ATM fees and make the most of your money. This is especially helpful if you travel a lot.

6. Referrals

If you use Simple and decide that you love it, you’ll probably want to recommend it to friends and family members who you know will love it too. That’s completely understandable, and a huge part of how Simple became so successful after starting up.

Luckily, Simple offers users a nice incentive to refer friends: A hefty referrals program!

Once you sign up for Simple, you’ll receive a unique referral link, which you can send to your friends and family by email, text message, or social media. If your friend clicks on your link, creates a Simple account, and makes their first purchase, both you and your friend will receive $20.

Simple Shared

Simple Shared is one of Simple’s newer features, and it’s something that people are really excited about.

Simply put, Simple Shared is a Simple account that is shared by multiple people, which can be used to pay shared expenses or to reach shared savings goals.

Simple Shared is most often used by married or engaged partners who have shared expenses (mortgage, rent, utilities, etc.) and goals (wedding, vacation, etc.). But it can also be used in other situations: For example, a parent and their college-age child may share an account to ensure college-related expenses are paid for.

Our Review

Though Simple has a lot of great features and a noble mission compelling them forward, there are some spots where they may fall a little short. It’s important that you weigh all of the pros and cons of working with Simple before you decide one way or another whether you want to open an account.

Benefits of opening a Simple checking account

- No minimum monthly balance: If you open a Simple checking account, you never need to worry about dropping below a minimum monthly balance, because there is no minimum monthly balance. You can have $0 on your account and it would be fine. You can also open your account with as little as $0.

- No fees: Simple promises not to charge users fees, period. This means: There are no minimum monthly balance fees, there are no monthly maintenance fees, there are no overdraft fees, there are no fees for using ATMs inside or outside Simple’s ATM network, there are no fees for transfers into or out of your Simple account, and there are no fees for closing your account if you choose to do so.

- Access to more than 40,000 ATMs: Simple is a part of the Allpoint ATM network, which consists of more than 40,000 ATMs across the US. If you use one of these ATMs, you won’t pay a fee to Simple or to the ATM. If you use an ATM outside of the network, you may be charged an ATM fee by the business holder, but Simple still won’t charge you a fee.

- Great features for budgeting and saving: Simples Expenses and Goals tools are designed to help make it easier for you to budget, save, and understand exactly how your money is being spent. They’re great tools, especially for people who are new to personal finance.

- 2.02% interest for Goals with at least $2,000: Which is a highly-competitive rate compared to most national banks.

- Multiple ways to use: You can choose to use Simple through either their online web portal or through their smartphone app (for both Android and iOS), whichever you prefer.

- Easy to use: Both the online web portal and smartphone app are incredibly easy to use and navigate, a big plus over many big-bank apps (I’m looking at you, People’s).

- You get a physical debit card: Which you can use in your everyday shopping instead of switching between multiple bank cards.

- Five ways to transfer money: Whether you need to transfer money between Simple accounts, to an outside bank, or you’d like to send a physical check, Simple has an option for you.

- Shared accounts: Simple Shared is an option for customers who would like to create joint accounts that enable them to save for and cover joint expenses, perfect for couples, roommates, and parents/their children.

Negatives of opening a Simple checking account

- Low interest rates: Money held in your Simple checking account will gain a measly 0.01% APY. This is standard for many checking accounts, but there are alternatives (like Ally) which could offer you more. If you use Simple predominantly for checking, this shouldn’t be too much of a concern. But if you use Simple’s Goals function to save (and don’t keep the minimum required balance to qualify for their higher rates) you could likely be gaining more money with a different account elsewhere.

- Online only: Simple has no physical locations. Though you can deposit checks through their online check depositing function, this means that there is currently no way to deposit cash, which may be a negative for those who work in businesses that rely heavily on cash.

- U.S.-only: Right now, Simple is only available in the US, while many other larger banks are available internationally.

- Only offers checking accounts: Simple currently doesn’t offer savings accounts, CDs, loans, credit cards, or investment options or other products like you might find with a bigger bank like Ally. That said, Simple’s Goals functionality is very similar to a savings account.

The Bottom Line

The bottom line here is that I personally love the Simple banking app, and that I think you will too. Simple is great for college students, graduates, and really anyone who is tired of working with big banks who like to charge you fees and make banking way more complicated than it needs to be. It’s got a lot of great features and functions designed to help you save money and spend smarter.

If you’ve been looking for a new banking partner and haven’t known where to start, Simple may be great for you.