This post may include affiliate links. Please read the disclosure at the bottom of our “About” page to learn more about our affiliate program.

Did you know that the average family of four in the US throws away just under $1,600 in food each year? That’s nearly $400 a person!

When I read that stat, I was shocked—that’s so much money! But I’m just as guilty as the next person. Just last week, I was grocery shopping when I spotted a jumbo bag of kale on sale for $5. I threw it in my cart, drove away, and tucked it in the crisper with a few other veggies I had been inspired to buy. Jump ahead to yesterday, and I was chucking the whole bag of kale and a few pears in the trash, simply because I had forgotten about them. Add to that the little scraps of leftovers—mashed potatoes, rice, etc.—that had accumulated in the week, and it’s quite possible that I threw away about $15 worth of food.

Sometimes we throw away food due to aesthetics—bruises, discolorations, etc.—that makes produce less appetizing. Sometimes we throw away food because we buy it and it goes bad before it’s used (see above). Sometimes it’s because an expiration date has passed, and who knows if it’s still safe to eat.

Whatever the cause, one thing is clear: Americans are throwing a whole lot of money in the trash can each year. Money that could be used for other things, like reaching important financial goals. Read on below to see how an extra $1,600 in your yearly budget could really impact your finances.

1. Use it to start an emergency fund

Most financial experts recommend that you have a separate savings account set aside specifically to cover emergencies.

Called “emergency funds,” these savings accounts are meant to provide for life’s unexpected moments: An emergency root canal, a trip to the ER, new tires so you can get to and from work. In an ideal situation, you’d have three to six months’ worth of expenses socked away in your emergency fund so that you could weather an unexpected job loss. People who are self-employed or work in volatile industries might want to have even more saved up—closer to a year’s worth of expenses. Exactly how much you need will depend on your own financial situation.

If that sounds like too much, don’t worry: If you were to cut your food waste down to zero for the year and dedicate all of that $1,600 to your emergency fund, you’d already by miles ahead of most Americans, who don’t even have $1,000 set aside for emergencies. Do this for just a few years, and you’ll be well on your way to hitting the three to six months’ expenses goal—simply by throwing away less food!

2. Use it to begin investing for your future

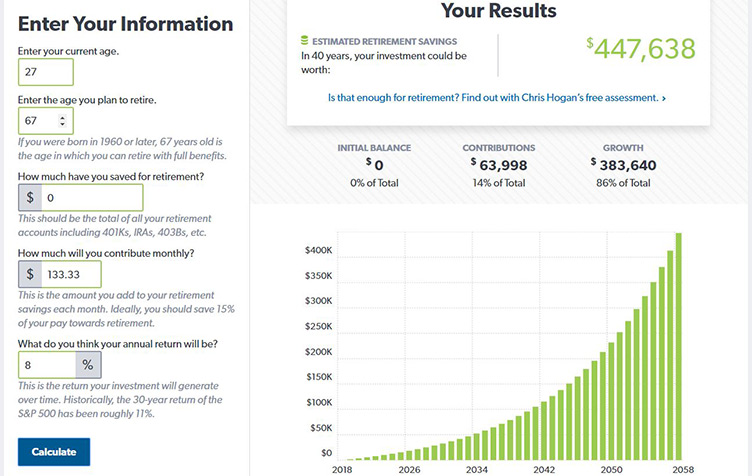

A lot of people want to get started investing for their future—for retirement, a home down payment, etc.—but never begin because they think they need big bucks to get started. But the truth is, investing anything is a whole lot better than investing nothing (and there are tools out there like the Acorns investment app or Stash Invest that are specifically designed for those who don’t have a lot of money to invest). Thanks to the power of compounding, even a modest investment of, say, $1,600 a year can turn into a substantial nest egg.

Just how substantial? Well, if you were to invest $1,600 a year and earned a realistic 8-percent return annually on your money, your portfolio would be worth just shy of $450,000 after 40 years. Even a much more conservative portfolio yielding a 4-percent annual return would mean you’d have more than $150,000 after 40 years.

That’s not a bad outcome for simply wasting less food.

3. Use it to start a college savings fund for your children or grandchildren

It’s no secret that college is expensive, and that it’s only going to get more expensive as time goes on: Right now, college tuition is growing at a rate of about three percent a year. That means that if tuition continues to grow at the same rate, college is going to be a whole lot more expensive for the college students of the future. Tuition of $24,000 today, growing at 3 per year, translates into about $41,000 in 18 years!

And that means a whole lot of student loans for the college students of the future.

But there’s some good news for parents who want to help their children keep student loans to a minimum. By opening a tax-advantaged college savings plan for your child, you can drastically reduce the amount of money they’ll need to borrow in the future, making it a lot easier to pay off their student loans once they graduate.

These accounts are quite literally investment accounts specifically designed to provide for college expenses. You choose your investments, invest the money that you can, and allow it to grow. Then, once your child is accepted to college or a trade school, you can access the money tax-free to cover everything from tuition to room and board, textbooks, and other supplies.

If you were to invest your food waste savings for 18 years, and it earned eight percent a year, when your newborn child was ready to go to school in 18 years you’d be able to help them out with almost $65,000.

4. Use it to pay down your debt

Okay, so this one should be obvious, but just in case it isn’t: Whether you’ve got credit card debt, a mortgage, or, ahem, student loans, funneling the money you save by throwing away less food into paying down your debt can have a really big impact on your debt repayment strategy.

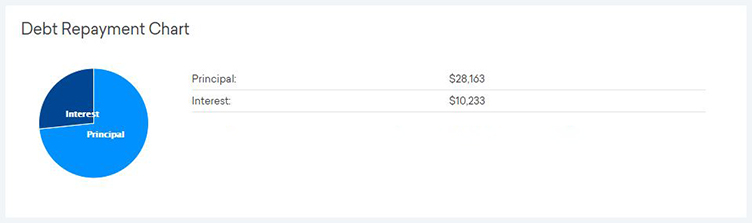

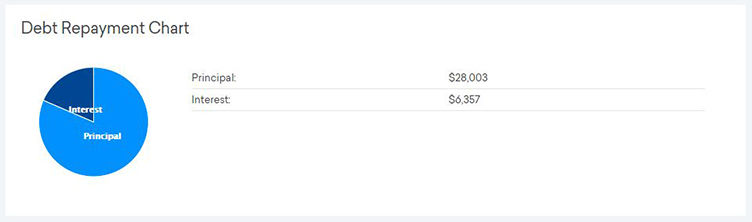

Need some numbers to put that all into perspective? If you’ve got a $28,000 student loan with an interest rate of 6.8%, and a minimum monthly payment of $331, it would take you 10 years and $38,396 to pay the loan off. And $10,233 of that would be in the form of interest.

If you were to pay an extra $133.33 each month (the amount you’d save by reducing your food waste by $1,600 each year) you’d pay $464.33 each month. That would shave nearly 4 years and $3,857 of interest off of your student loan repayment.

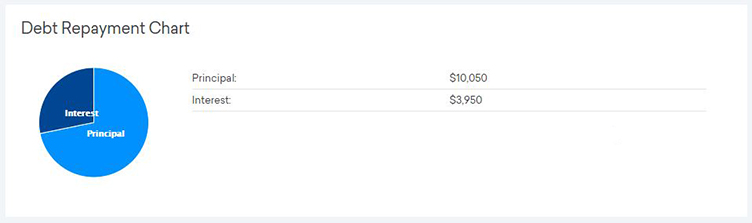

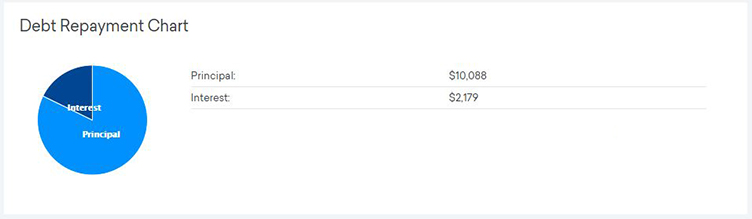

Don’t have student loans? First of all, lucky you. But the principle holds true to any kind of debt, and can mean even bigger savings. Let’s take credit cards as an example. Let’s say you’ve got $10,000 on your credit card, an interest rate of 15%, and you pay a minimum monthly payment of $250. In this scenario, it’d take you 56 months to pay off your credit card, and you’d pay a total of $14,000—and $3,950 of that would be in interest!

On the other hand, if you were to pay an extra $133.33 each month (for a total monthly payment of $383.33) you’d pay the credit card off in 32 months and pay a total of $12,267. Only $2,179 of that would be interest—a savings of $1,771.

(Check out this awesome calculator at Credit Karma to run your own debt repayment numbers!)

5. Use it to have a little fun

Okay, fiscal responsibility is nice and all, but sometimes you need to have a little fun with your money. An extra $1,600 a year can go a long way in helping to make life a little more fun and exciting.

By simply reducing your food waste, you could buy a new camera for some *professional* Insta posts, veg out in front of the latest gaming system, take a two-week trip to Thailand, or do countless other things. And all you have to do is make some smarter choices when you go shopping.

How to Get There

Ready to start reducing the amount of food you and your family wastes so that you can help make the planet, and your wallet, a little happier? That’s great! It’s important that you keep in mind that you won’t necessarily have to do anything drastic to get there. With a few simple strategies, you could easily hit your goals of wasting less food:

- Shop with a specific recipe or meal in mind, so that everything you buy is accounted for. This will keep you from making spur of the moment purchases (like me and my kale) that just rot in the fridge.

- Prep fresh produce and freeze it while it’s still fresh, if you don’t think you’re going to be able to use it before it goes bad. Foods like onion, garlic, herbs, and other veggies are perfect for this.

- Hold onto your food scraps (bones from meat, vegetable roots and peels, etc.) in the freezer and use it to make free and delicious stock.

- Cook less food. If you find that you’re throwing away a lot of leftovers at the end of each week, then you’re probably just cooking too much food at once. All those small scoops of mashed potatoes, half-servings of rice, etc. start to add up, and by cooking less you’ll find that you can save a lot of money over the course of a year.

A lot of common sense ideas here. But getting an 8+% return on investment isn’t easy these days. Well written post Tim.

Thanks for your thoughts!

Earning 8% can be tough if you’ve got a conservative portfolio or hold a lot of bonds compared to stocks (which would be typical of someone in or nearing retirement). But for people who have a long time to wait until they need their money, they can afford to be a little riskier and invest in more (or all!) stocks. The S&P 500 has returned a whopping average of 9.8% annually over the course of the last 90 years.

But to your point, it’s all about your investment timeline and your tolerance for risk. Even if you earned 3% on that $1,600 could turn into $124,000 over the course of 40 years! Plopping it in a high-yield savings account or CD yielding a 1% return would grow to $79,000 after 40 years. I wouldn’t recommend going this route, but it certainly is better than throwing the money away!