This goes without saying, but I’m going to say it anyway just so we can put all of the cards on the table: College is expensive. Between tuition, housing, meal plans, textbooks, and random fees and supplies, the cost of attending a state university for one year can easily top $25,000. Do you have an extra $25,000 per year lying around so that you can pay the bill?

Probably not. And that’s where student loans come into play: Somewhere around 70 percent of college graduates in 2016 carried at least some college debt. But take it from me, student loans are expensive to pay. When you’re fresh out of college and looking to start out on life, the burden of any kind of debt puts a real damper on your plans.

Need help keeping track of your student loans? Download our free Student Loan Spreadsheet!

If you don’t have the money to pay for college up front, then there’s little you can do aside from taking out loans. But if you can reduce your expenses now, then you can take out fewer loans to pay for college, and that will ultimately make paying back your student loans easier and cheaper. Here are some ways that you can lower your college expenses so that when you graduate you can actually afford to move out of your parents’ basement.

1. Start at a community college.

This isn’t what you want to hear, because in our society college is viewed as a time for having fun and “discovering yourself.” But it’s hard to argue with the fact that community colleges are a lot less expensive than your typical four-year university. By starting at a community college for your first two years (getting those pesky gen-eds out of the way) you can save yourself a lot of money: Especially when it comes to room and board.

2. Better yet, start in high school.

Many high schools offer advanced classes that, upon completion, will count toward your college credits. If you are lucky enough to be in one of these schools, then by all means take as many of those classes as you feasibly can: They’re usually cheaper than what you’d pay to take the same classes at a university, and they can save you valuable time (and the room and board that comes with it).

When I was a senior in high school, I was able to take five college classes that translated into 17 credits. That saved me a full semester’s worth of work and money—especially when I decided to switch majors after my first year.

3. Take winter and summer courses.

I know that your summer and winter vacations are when you want to catch up with old high school friends and spend some time relaxing, but taking a couple of courses each summer and winter can add up to a lot of credits, which can easily shave a semester or two off of your college enrollment. This means you’re 1.) spending less money on room and board and 2.) will graduate earlier, giving you more time to work and actually start making money. It’s a win-win. Classes rarely go past 5pm; you can socialize after.

4. Live in a state that offers free college tuition.

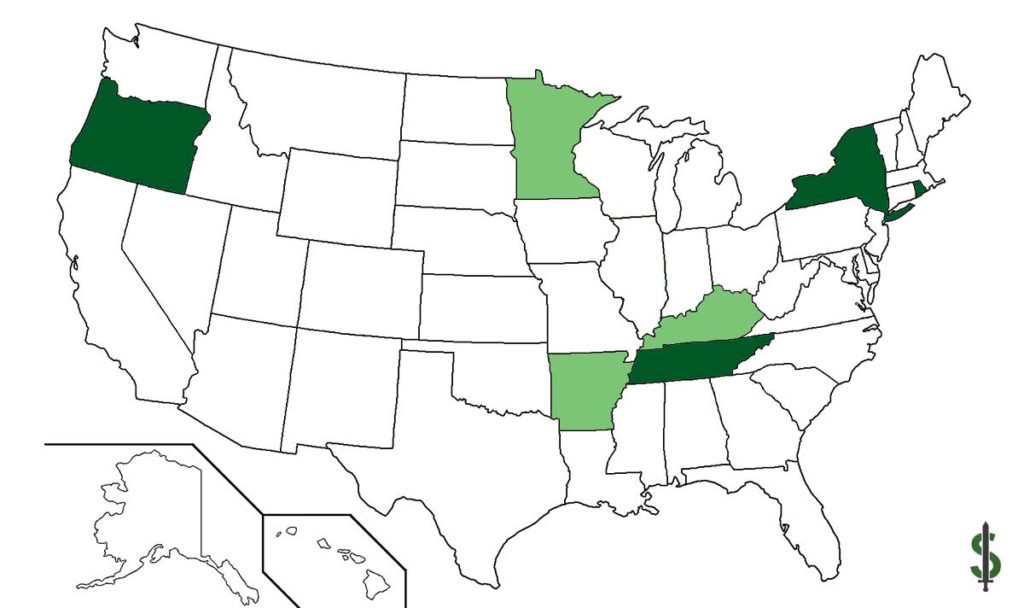

Okay, so this one is kind of on your parents, and not really something that you can do if you’re already a student enrolled in college. But in all honesty, living in a state that offers a free college tuition program is a great way to save money on your education. As of August 2017, four states offer free tuition: New York, Oregon, Rhode Island, and Tennessee (dark green in the map below) and three additional states have watered down versions: Arkansas, Kentucky, and Minnesota (light green in the map below).

Eligibility requirements vary by state, so make sure you check into things before deciding to up and move. But still: Getting your education for free is one way to seriously cut down on your college expenses. Most of the states above require that recipients of funds be a resident for only 1 year before application, though Arkansas requires three years of residence.

5. Live at home if you can.

The average cost of room and board at a four-year university can easily top $10,000 each year—a substantial part of what you are paying to attend. If you are going to a college near home, you can save a lot of money by opting to continue living with your parents. Or, if your parents live too far away from your college, but another family member (aunt/uncle, grandparents, etc.) live closer, talk to them about the possibility of staying with them in exchange for nominal rent or helping out around the house.

It might not be what you had in mind when you imagined all the fun that comes with college, but try framing it another way to see the value: While all of your friends are moving back in with their parents after college because they can’t afford rent on top of their student loans, you’ll be moving out on your own.

6. If you can’t live at home, don’t splurge on college housing.

College housing gets a bad rap nowadays: The rooms are small, you never have AC, the heat doesn’t work in the winter, and you’re going to be sharing the bathroom with 20 other guys (or girls) on your floor, most of which you don’t think have ever cleaned a sink in their lives. To make up for this, many colleges offer “premium” residence halls (they might be called “suites,” “singles,” or “apartments” at your university).

Landing a spot in one of these residence halls is often a prime aim of college students, and for good reason: The rooms are bigger and the bathrooms are shared by fewer people. The only downside is the difference in price—and believe me, there is going to be a difference in price.

When I went to UConn, these places cost an average of $1,000 more each year than the other dorms. Four years of living in these higher end dorms will set you back at least $4,000—which you’ll probably be paying for with student loans. Is a bigger room and only slightly less disgusting bathroom really worth all the extra you’re going to have to pay back in the form of principal and interest? I don’t think so (although, unfortunately, college me did).

7. Become a Residential Assistant (RA) for cheaper on-campus housing.

Becoming a residential assistant (RA) isn’t for everyone, but it comes with some great perks: Especially if you’re looking to save on your college expenses. Compensation packages for RA’s vary by college, but they almost always include reduced housing fees (sometimes making housing completely free!). Other financial perks may include a stipend, meal plan, or tuition remission.

And of course, you usually get a room to yourself, making studying a lot easier (so long as you aren’t constantly being called to calm down students freaking out about exams or breaking up parties). If you think you can handle the stress, you can dramatically slash your college expenses this way.

8. Learn to cook!

If your school allows you to do so, opting out of a meal plan/dining hall contract can save you a lot of money. Seriously. According to data collected by the U.S. Department of Education, the average college or university charged students about $4,300 for a meal plan for the 2015 academic year. All told, that means that the average student paid around $7.50 per meal.

To put that in perspective, the Bureau of Labor Statistics says that the average single American spends about $4,000 on food for the entire year, or about $4.00 per meal (with the occasional meal out included).

So the message is clear: If your school allows you to opt-out of a meal plan, you can save a lot of money by cooking cheaper meals for yourself and pocketing the difference.

That being said, some of my fondest memories from college revolve around eating in the dining hall with my friends. It’s a shared bonding experience—finding the best dining halls on campus, learning when they’re busy and when they aren’t, etc. Whether or not you are willing to give up those moments is completely up to you; I don’t think I would have been able to give it up.

9. Rent textbooks in lieu of buying them new.

If you are a medical student or are in some other field where you think you’ll need to constantly refer back to your textbooks, then, by all means, buy them so that you actually own them. But if this doesn’t apply to you, or you’re just taking a class to fulfill a gen-ed, then there is no reason that you should buy a book just to sell it back to the bookstore for a fraction of the price at the end of the semester.

Instead, you should rent. By renting a textbook, you can save a lot of money that you would otherwise need to use your student loans or a credit card to cover. If you really think that you’ll want to hold onto a textbook after the class is over, then make sure you bargain hunt online for the best deal (SlugBooks.com can help you comparison shop).

10. Take advantage of tax savings.

College is already expensive, so why not take advantage of tax savings whenever possible to save a little extra? Start by checking out our list of states with tax-free holidays, and use it to plan your college spending. By buying your college essentials during these sales tax free days, you can save a substantial amount of money, on everything from clothing to school supplies to even textbooks. If you’re lucky, you might live in a state that already always exempts textbooks from sales tax. Know before you buy!

11. If you have federal work study, make you put the money towards your loans.

When I was in college, I hardly ever thought twice about spending my federal work-study funds on the things that I wanted—like the occasional trip to the bar for Thirsty Thursdays or late-night wings to keep me fueled through an all-night essay session. After all, I had earned that money through my own hard work. Who’s going to tell me how to spend it?

In the end, I don’t think I ever put a single cent of my work study funds towards actually paying for my college essentials. I let the loans cover my expenses and used my work-study to have fun. And I have never been more disappointed with myself over anything else in my financial life.

On average, students who receive federal work study earn somewhere between $1,500 and $1,800 over the course of a semester (I earned $900 each semester). This money can be put towards things like textbooks and supplies, can be used to pay down interest while you are in school (meaning that you’ll own less when you graduate) or can buy you greasy chicken wings at 2am on a Saturday night. What do you think is honestly the best course of action?

12. If you don’t need it, leave your car at home.

For most college students, having a car on campus is a big deal. It allows you to drive home whenever you want to save a few bucks on laundry or see friends, and it gives you the freedom to get off of campus. But it comes at a cost: Namely in the form of fees for a parking permit.

These fees will differ depending on your school, but as an example let’s look at my alma mater: UConn. A parking permit at UConn can cost you anywhere from a low of $244 to a high of $428 per school year. That means that having a car on campus will cost you anywhere from $976 to $1,712 after four years: Money that you could have used to pay down your student loan interest while in school.

These are great!

I especially liked the winter and summer class idea. Finishing faster is an awesome way to reduce debt. I also really liked the renting textbook idea. Textbooks can be ridiculously expensive, and who reads them after graduation anyway? I rented several books, used some of the textbooks from the school library, and bought previous editions when possible to keep my costs low.

Tuition and fees can’t be changed, but cutting costs on the other “big win” cost areas like housing, books, food, and transportation can save some serious money!

You might like a similar article I wrote about defraying college costs. Check it out here: http://workhardlivefree.com/posts/10-tips-to-debt-proof-your-degree

Thanks for another great article, Tim!

Excellent post and such a useful list!