This post may include affiliate links. Please read the disclosure at the bottom of our “About” page to learn more about our affiliate program.

When you’re new to investing, it can be difficult to know exactly where to start. There are so many terms and options that it’s easy to find yourself paralyzed, not wanting to make a mistake. But you also know that investing consistently and regularly over time is the surest way to begin building wealth, and the sooner you can get started, the better. College students and recent graduates, especially, should start putting their money to work as soon as possible to help them reach their financial goals.

The Stash investment app was specifically designed to make it as easy as possible for you to start investing so that your money can begin to grow. It does this in a number of ways, relying on modern technology, automation, and low costs to bring easy investing to everyone.

Want to learn the basics of investing? Check out our guide to the essential investment terms and definitions for beginners!

If you’re looking for an investment app that is easy to use, doesn’t require a lot of money to get started, and gives you a bit more control to build your own portfolio of investments, the Stash investment app might be a great place to start.

Before we dive into the specifics about Stash, though, I just want to say that if you read this article, click on the link that I provide to sign up for Stash, and do actually sign up for the service, I do earn a little bit of money. Specifically, I earn $5 that will be deposited directly into my Stash account. But the awesome thing is, you’ll get $5 too!

This might seem like it’s incentive for me to talk up the app just to get people to sign up, but that’s honestly not the case. I wrote this article because I believe that Stash is a.) a great service, b.) a great way for college students, recent graduates, and other new investors to start investing, and c.) an easy way to mindlessly start saving and investing money.

I personally use Stash to manage a portion of my investment funds, and I recommend it to a lot of my friends who want to start investing for their future.

Table of Contents

1. What is Stash and how does it work?

2. How to create a Stash account

3. Stash fees

4. What kind of portfolios does Stash offer?

5. Buying individual stocks with Stash

6. How to make money with Stash

7. Stash Retire

8. Stash Banking/Debit Card

9. Stash Learn

10. The bottom line

Key Facts

- Stash was founded in 2015, and since then more than 3 million people have signed up for an account.

- Stash has three different risk-based portfolios—Conservative, Moderate, and Aggressive—for users who do not want to actively manage their accounts.

- In addition to portfolios, Stash offers investment “Themes” which allows users to invest in specific industries or themes.

- Users who want to build and manage their own portfolio from scratch can also use Stash to buy stock in individual companies.

- You only need $5 to open a Stash account and begin investing.

- Stash has three payment tiers: $1 per month for an investment account and debit account; $3 per month for an investment account, debit account, and retirement account (IRA); and $9 per month for an investment account, debit account, retirement account (IRA) and custodial accounts for up to two children.

- Stash Retire launched in the Spring of 2018 to allow users to begin investing for retirement.

- Stash Banking and the Stash debit card launched in November 2018.

- Parents who would like to open an account for a child younger than 18 years old can open a custodial account which can be transferred to the child once they are an adult.

What is Stash and how does it work?

Stash is an investment app that was created with the idea that it shouldn’t take a lot of money for people to begin investing and saving for their future.

Time is the single most important and powerful tool that we have when it comes to growing our money, and waiting until we have a lot of extra cash to start investing is a surefire way to squander that time. That’s why Stash was designed to let you start investing with as little as $5. ![]()

The app was built using a feature called “Auto-Stash” that helps to make investing and automatic and easy. By automating your investing, you no longer have to make the conscious decision to move your money around.

Auto-Stash can work in three ways.

- Set a schedule: This option allows you to recurring deposit directly into your stash account. The schedule can be either weekly, biweekly, or monthly. You can choose to either transfer cash (which you can invest later) or, if you know you want to make the same investment over and over again, designate that investment so that it happens automatically.

- Round-ups: These work very similarly to how round-ups work in Acorns. Simply link your debit or credit card(s) to your Stash account, and any time you make a purchase using a linked card, you will “round up” to the next dollar. (For example, if you buy a 75-cent pack of gum, 25 cents would be “rounded up.”) Those extra cents will be automatically transferred into your Stash account, where you can invest them.

- Smart-Stash (formerly called Smart-Save): The Smart-Stash option uses analytics, artificial intelligence, and machine learning to analyze your cash flow. Using that understanding, the app will then automatically transfer the ideal amount of money from your linked debit account to your Stash account. You can set a maximum transfer amount to ensure that you always control how much money is invested on your behalf.

Stash is built around 4 main services:

- Stash Invest: Which allows you to build an investment portfolio consisting of risk-based mixes, industry/sector-based themes, and/or individual company stocks. This is how most Stash customers use the app.

- Stash Custodial Accounts: Which allow you to open an account for a child under the age of 18. Once your child is an adult, you can then transfer the account over to them. This is great for parents who want to teach their children the ins and outs of investing.

- Stash Retire: Which allows you to open either a traditional or Roth IRA in order to begin investing for retirement in a tax-advantaged account.

- Stash Banking: Which is a debit card program marketed as an alternative to traditional banking. Users can use many ATMs free of charge, earn cash back on many purchases, and analyze their spending to find ways to save.

How to create a Stash account

Signing up for Stash is incredibly easy, and takes only about 5 minutes (or less) to do.

When you first start, the app will ask you a number of questions. These questions are designed to a.) get you thinking about your investment goals and b.) so that they can recommend a specific diversified portfolio to you that you can use to reach your financial goals. (Whether you decide to invest in the portfolio they recommend is completely up to you, but for absolute beginners, it’s a good idea to start there.

The questions Stash will ask include:

- How much volatility are you able to stomach in your investments?

- Do you plan on investing conservatively, moderately, or aggressively

- Are you a student, unemployed, employed, or retired?

- What is your annual income?

- What is your net worth?

- When do you expect to need the money: In less than a year, 2-5 years, or over 5 years

Your answers to these questions should heavily inform your investment strategy, so it’s really important that you answer them honestly.

After you’ve answered these questions about your investment style, Stash will need to verify your identity (by law) and will do so by collecting some sensitive information including:

- Your citizenship status (Are you a U.S. Citizen, a Green Card holder, a Visa holder, or do you have some other status?)

- Your Social Security Number (which they fully encrypt before sending)

- Your phone number and home address

- A few questions that have to do with financial compliance (whether or not you are a senior executive at a publicly traded company, are a broker, or have family who is)

After that, you’ve just got to agree to the terms and conditions, create a 4-digit pin, and your account is created!

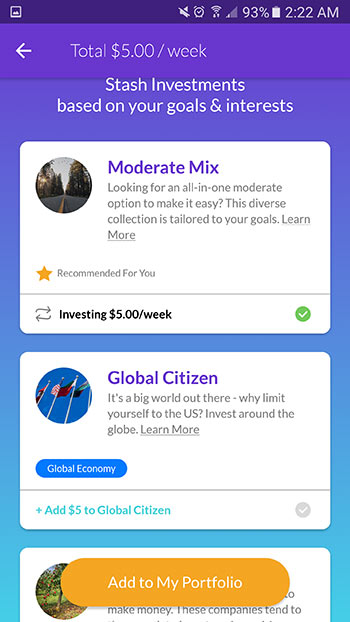

Your next step is to decide how much money you want to automatically save every week ($5, $25, $50, or $100 per week) and then link the app to your checking account. Once you find your bank, you will need to supply your bank’s routing number and your checking account number so that the app has access to transfer money when you tell it to.

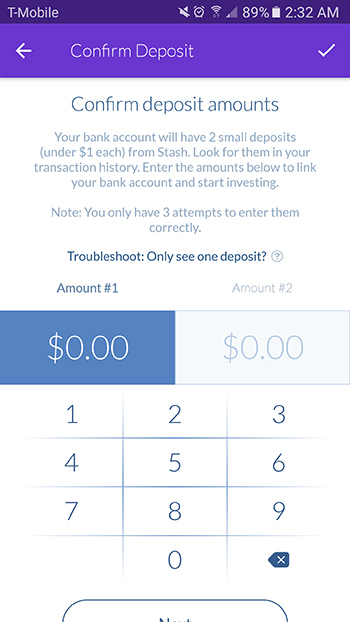

Stash will then make two small deposits into your checking account (each under $1) to verify your account. You’ll need to look at your transaction history in your bank, find each of those amounts, and enter them into the app to fully verify your account. Depending on your bank, it could take a few business days for the deposits to show, so just be patient.

And that’s it! Once your bank is verified, you can begin saving and investing using Stash. But even if it takes a while for the deposits to show up, you can begin poking around the app and learning more.

Stash Fees: How much does Stash charge?

When Stash first launched, the pricing model looked like this: Investment accounts cost $1 per month for accounts up to $5,000 and .025% per year for accounts over $5,000. Custodial Accounts were also $1/month. Stash Retire was slightly more expensive, at $2 per month for accounts up to $5,000, and then 0.25% per year thereafter.

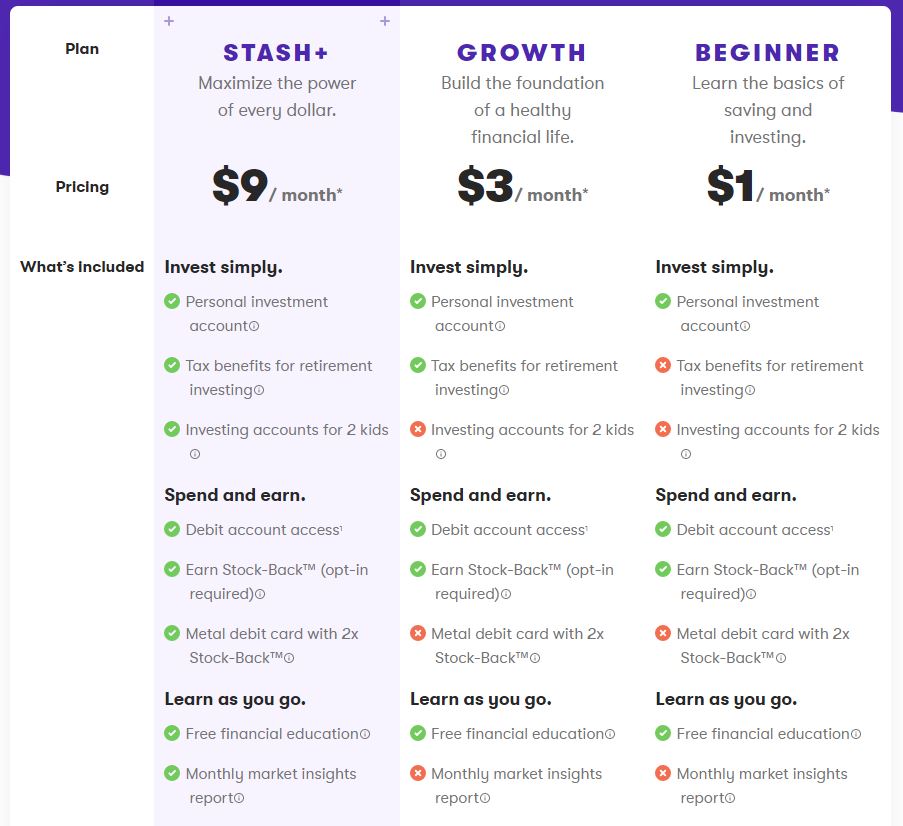

In June of 2019, Stash updated their pricing model to make it more competitive with other services. Now, pricing falls into one of three packages: Stash Beginner, Stash Growth, and Stash+:

- Stash Beginner costs $1 per month. The subscription includes a personal investment account (of any size), access to Stash Banking, and the ability to earn stock-back when you make purchases with your Stash debit account.

- Stash Growth costs $3 per month and includes everything from Stash Beginner. Additionally, users gain access to retirement accounts through Stash Retire.

- Stash+ costs $9 per month and includes everything from Stash Growth. Additionally, users gain access to custodial accounts for up to two children, a metal debit card that will allow you to earn two times the stock-back rewards, and an additional monthly market report that you can use to guide your investment strategy.

What kind of portfolios does Stash offer?

When it comes to investing through Stash, you’ve got a lot of options. There are more than 40 different funds that you can choose from.

These portfolio options fall into two broad groupings: Risk Level Mixes, and Investment Themes.

1. Risk Level Mixes

The risk level mixes offered by Stash are essentially pre-designed portfolios that are meant to roughly align with an investor’s risk tolerance and long-term investment goals. Each consists of a range of ETFs designed to give investors a wide range of diversification in both stocks and bonds.

Once you’ve gone through the signup process, the app will typically recommend one of these risk-based mixes to you to get started.

Stash’s three risk-based portfolios are:

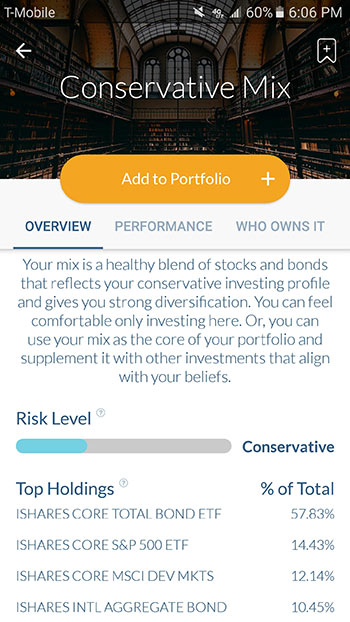

- Conservative Mix, which consists largely of bonds, along with some stocks. The bonds, being a more stable investment, allow you to earn a bit of money on your investment while safeguarding you against rapid swings in value. The stocks, on the other hand, are a little riskier, and offer you the potential to make a bit more money on your investment. This portfolio is good for those with extremely low risk tolerance or who will need/plan to use their money in the short term. It will at least allow you to (hopefully) keep up with inflation.

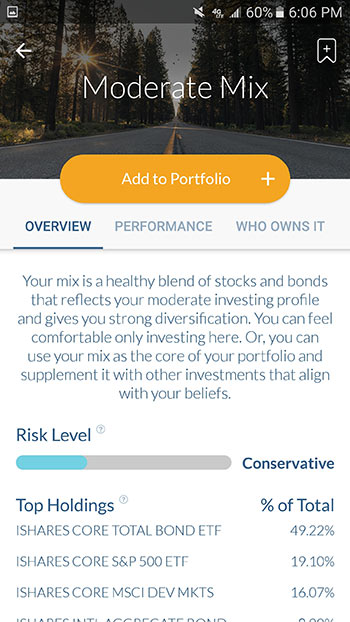

- Moderate Mix, which is roughly evenly split between stocks and bonds (it’s got a bit more stocks than it has bonds), giving your money the opportunity to grow while also insulating it a bit from wild swings in value. This mix is best suited for people with a moderate risk tolerance and who don’t expect to need their money in the short term. It would hopefully outpace inflation and allow you to actually make some money off of your investment.

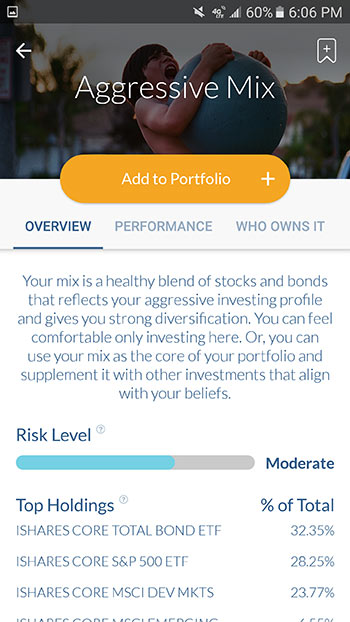

- Aggressive Mix, which consists predominantly of stocks, with some exposure to bonds. This gives your money the potential to grow substantially, but also means that you’ll be open to potentially wild swings in valuation. That makes the aggressive mix ideal for investors who have high risk tolerance and who are investing for the long term—say, retirement.

These mixes are ideal for set-it-and-forget-it investors who don’t want to actively manage their accounts.

2. Investment Themes

Want to take a little more control over the specific companies or industries that you invest in? With Stash’s Themes, you can.

Each theme is built around a particular idea or concept consisting of ETFs. For example, some possible themes that you can invest in are things like:

- Blue Chips, which invests in large, established companies

- Clean and Green, which invests in clean energy and similar stocks

- Equality Works, which invests in companies that champion LGBTQ+ rights

- Women Who Lead, which invests in Women-led companies

- Internet Titans, which invests in, well, internet titans

- Robots Rising, which invests in robotics companies

- Corporate Cannabis, which allows you to invest in companies involved with marijuana

- And many, many more

Each of these themes offers a portfolio that is diversified at least within an industry (none of them consist of a single company). That being said, the themes are likely not as diversified as the mixes above, and are therefore a tad riskier.

Don’t know what you want to invest in? When you first start using the app, you will have the opportunity to tell them the kinds of things that matter most to you, which they will use to recommend themes that you might be interested in. Below, you’ll see my selections…

along with the specific recommendations that Stash gave me in terms of Themes that I should consider investing in.

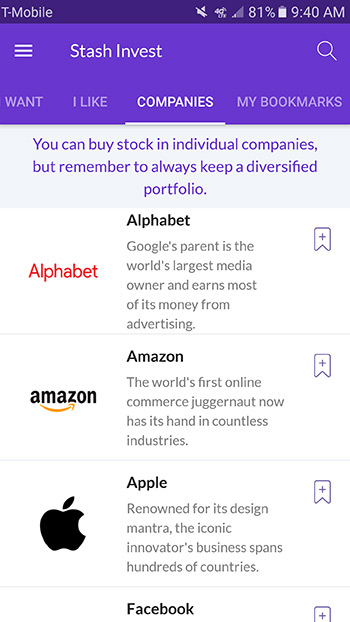

Buying individual stocks with Stash

Want to take complete control over your investments by building your portfolio from scratch? Starting in February of 2018, Stash began allowing user to do just that.

It’s important to note, though, that it is not possible to invest in any individual company through Stash: There are thousands of companies on the stock market, but Stash has chosen to only offer the most popular, high-value companies to their users. Some of the more popular of these companies include:

- Alibaba (BABA)

- Alphabet (GOOGL)

- Amazon (AMZN)

- Apple (AAPL)

- Boeing (BA)

- Cisco (CSCS)

- ExxonMobil (XOM)

- Facebook (FB)

- General Electric Company (GE)

- Home Depot (HD)

- Johnson & Johnson (JNJ)

- Microsoft (MSFT)

- Netflix (NFLX)

- Nike (NKE)

- NVIDIA (NVDA)

- Snapchat (SNAP)

- Starbucks (SBUX)

- Coca-Cola (KO)

- Disney (DIS)

- Walmart (WMT)

These companies live within their own tab in the app, making it easy to find the individual companies available.

You should also keep in mind that investing in individual stocks is extremely risky: If that one stock does poorly, then the value of your portfolio can take a substantial hit. That’s why it’s important to make sure you diversify your investments. Themes and Mixes all offer at least some level of diversification that you won’t find with individual stocks. If you decide to invest in these individual stocks, you should be sure to choose a number of companies from different industries so that you can safeguard your investments at least somewhat.

The other good news is that, just like with their Themes and Mixes, investors only need $5 to buy into individual stocks. This is possible through the concept of “fractional shares,” which essentially means that you can purchase a small portion of a share even if you can’t afford a full share. (That’s the same way that their ETFs work, in essence.)

How can you make money with Stash?

People who use Stash can potentially earn money in a number of ways, including by:

1. Selling an investment that has grown in value.

It is important, though, to keep in mind that investing for the long term is a surer way to build wealth than by trying to time the market.

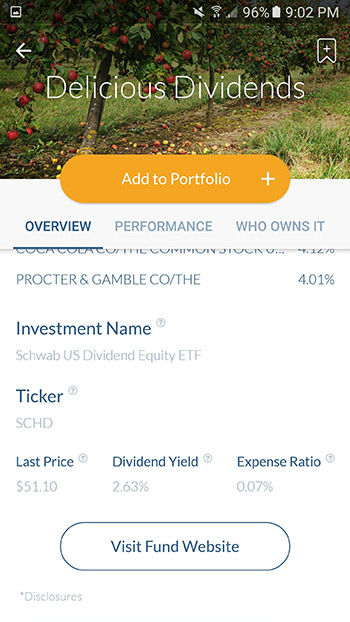

2. Receiving a dividend from a company or theme.

Dividends are essentially a portion of a company’s profits that are paid back to investors. Though they are not guaranteed, many companies pay dividends; they’re incentives for investors to hold onto your stock, and many investors build their portfolios around dividend-paying companies because they act as income. In fact, Stash even offers an investment Theme called Delicious Dividends that consists largely of companies known to pay out strong dividends.

3. Referring a friend.

When you sign up for Stash, you will receive a referral link (like mine here) that you can send to friends and family members. If they sign up for Stash by using your referral link, both of you will earn $5, deposited into your account.

Normally you can earn up to $500 each year through referrals, but sometimes Stash will have special promotions where you can earn more—say, $100 if 10 friends sign up.

4. Receiving cash back.

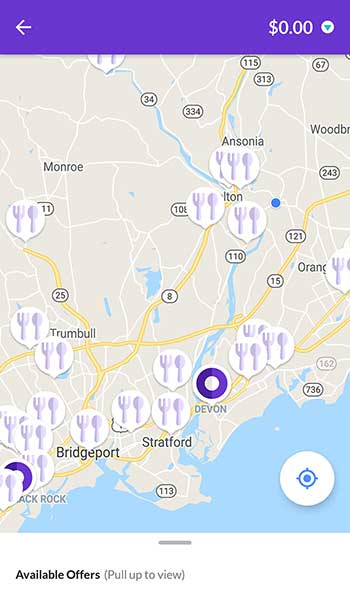

If you choose to, you can link up to three debit or credit cards to your Stash account. Then, any time you shop at a participating merchant or restaurant, just run your purchase as a credit and you’ll earn cash back, which will be deposited into your Stash account monthly (at which point you can invest it as you choose).

The exact cash back deals will vary by location, date, and merchant, but can be up to 10% of a purchase up to $250. A handy built-in map will help you spot the places near you who have active cash back deals. The counter in the upper right corner of the screen will keep a running tally of all of your cash back, until the end of the month when it is transferred into your account.

Though you don’t need to sign up for Stash Banking to enroll in the cash back program, you can link your Stash debit card if you wish.

How much money can you make with Stash?

As with any investment, it’s impossible to predict exactly how much money you’ll make by investing through the Stash investment app. There are just so many variables to take into account: Which portfolio you choose, the assets that make up that portfolio, etc.

That being said, the app includes information on each portfolio’s past performance, which details how well it has performed in the last 12 months, 3 years, 5 years, 10 years, and in total (since inception). Past performance is no indication of how an investment is going to perform in the future, but it can be helpful in spotting trends in the market

Determining your account’s potential future value

Stash knows that investing can be confusing for newbie investors, especially when you start talking about things like percents and whatnot. But they also want to make sure that their customers understand just how important even a little bit of growth can be.

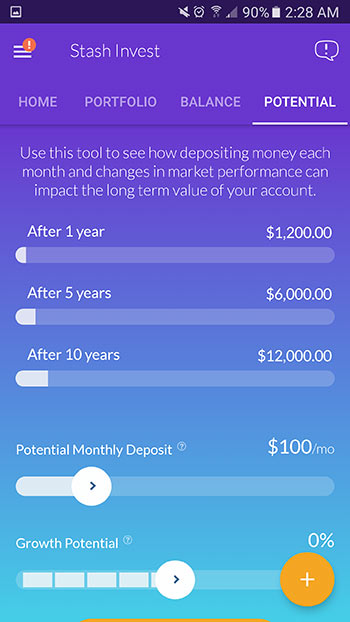

For that reason, they pulled together a nifty tab called “Potential” which is designed to show you how your investment might perform under different scenarios, over the course of 1 year, 5 years, and 10 years. For example, the scenario below shows you how much money you would have in your account if you invested $100 per month and earned nothing on your investment.

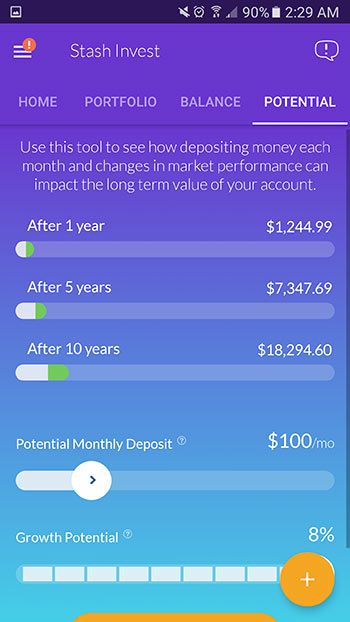

If you adjust the Growth Potential up to very reasonable 8% growth (For context, the S&P 500 has returned an average annual yield of almost 10% over the last 90 years), then you’ll see your balance rise accordingly. This growth is not a guarantee, but it’s meant to show you how even one or two percent return (or 4, or 8) can go far in helping you reach your financial goals.

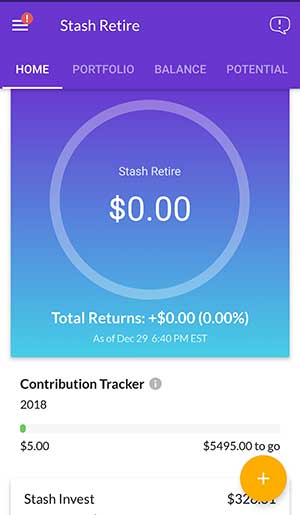

Stash Retire

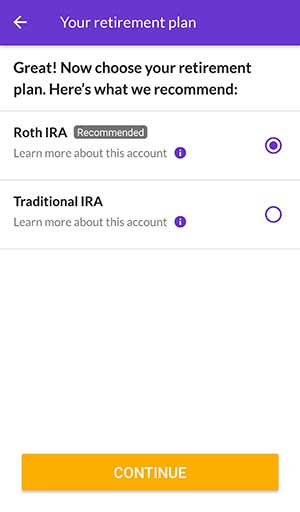

Stash Retire is a relatively new addition to Stash, having been introduced in the Spring of 2018. Essentially, Stash Retire allows users to open either a traditional or Roth IRA. These accounts come with a number of really powerful tax benefits, making them ideal for anyone who is investing for the long-term (i.e., retirement).

Exactly how does Stash Retire work? Just answer a few basic questions about your employment status and your income level, and Stash will recommend you open either a traditional or Roth IRA. (This recommendation is just that—a recommendation. You can choose whichever account you prefer, as long as you meet the legal requirements to do so).

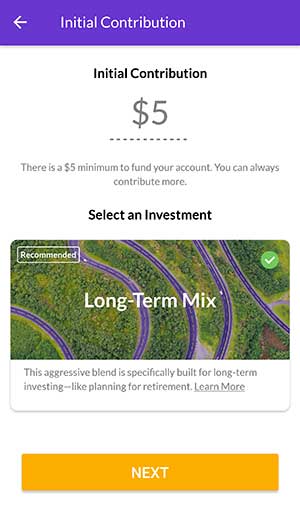

Then, you’ll choose an initial deposit amount (there’s a $5 minimum to open your account). This money will be deposited directly into a specific retirement portfolio that is designed to match your age. When you’re younger (and therefor further from retirement) this portfolio will be riskier; but as you get older and closer to retirement, it will become more conservative.

From there, you can set up a recurring investment of $5, $25, $50, or $100 to be made every week, every other week, or every month. Or, you can forgo the recurring investment and simply make one-time investments as you have the money. This money can be invested in the suggested fund, or you can choose from the same Themes or individual companies as you can with your regular Stash Invest account.

You can only contribute a certain amount of money to your IRA each year: $6,000 if you are younger than 50 years old, or $7,000 if you are older than 50 years old. The app includes a handy counter that slowly fills up as you work towards this maximum, helping you understand how much more you have to go.

Whereas Stash Invest costs $1 per month, your Stash Retire account will be slightly more expensive at $2/month for accounts under $5,000. Once the account reaches $5,000, however, you will pay 0.25% just as with your regular Stash account.

Stash Banking/Debit Card

Starting in December of 2018, Stash began offering a banking program to users of the app. This program is being called Stash Banking, though I’ve also seen it referred to as Stash Debit. The program works like this:

If you want to participate, you sign up through the app. Once your physical card is created, it’ll be mailed to you, which tends to take a few weeks. In the meantime, until you receive your physical card, you’ll be able to use a “digital card” through the app to make online purchases. Once you have the physical card in hand, you can use it to make purchases just like any other card.

Some of the benefits of the program include:

- Zero Fees: There is no fee to open an account, no monthly service fees, and no overdraft fees.

- No minimum balance: You can keep as much or as little money in the account without being penalized.

- Cash Back: Just like the regular Stash Cash Back program, using your Stash debit card could net you up to 10% cash back from participating merchants and restaurants. Stash claims that there are over 10,000 partner merchants worldwide.

- Fee-free access to 19,000 ATMs: A handy in-app map will help you find in-network ATMs for you to access your money if you need cash. You can also use out-of-network ATMs, but this will include a $2.50 fee from Stash as well as any ATM-specific fees.

- In-person cash deposits: Users will be able to deposit cash at thousands of participating CVS Pharmacies, Walgreens, and Rite Aids across the U.S.

- Spending Insights: Once you have made enough purchases with your Stash debit card, the app will be able to analyze your spending habits to help you identify ways to save money and spend smarter.

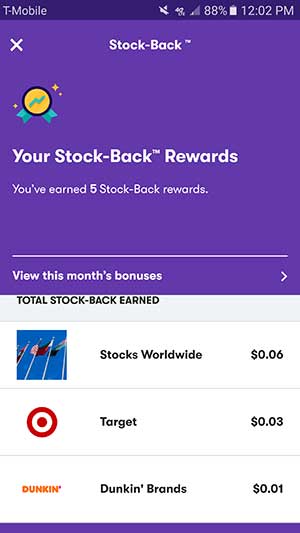

Stash Stock-Back

Stock-Back is a new program tied to Stash Banking. If you choose to opt into the program, then any time you make a purchase using your Stash Debit Card, you’ll receive a reward in the form of stock purchased and deposited into your Stash Invest account. Think of it as cash back, only with stock. (Duh.)

When possible, the stock that you earn will be tied directly to where you make your purchase. If you shop at a store or merchant whose stock is listed on Stash (for example, Walmart, Target, Amazon, or Starbucks) then the stock you earn will be that company’s stock. If the merchant you company isn’t listed in Stash, you’ll still earn stock—it’ll just be stock in an ETF instead of a single stock. According to a promotional email sent out to announce the program, the specific ETF is the Vanguard Total World Stock ETF (VT), though this can always change. This puts a whole new spin on the idea of “investing in the companies you spend on,” which is kind of neat.

Some quick takeaways:

- Most purchases, including gas, groceries, and restaurant meals will count

- Non-qualifying purchases include gift or prepaid cards and money orders

- You’ll receive a push notification when you make a qualified purchase to show that you’ve earned some stock back

- The stock you earn will be deposited in your account 2-5 business days after your purchase

It is important to note that in order to opt into Stash’s Stock-Back program, you’ll need to allow Green Dot (the bank responsible for issuing and managing all Stash Debit Cards) to share your transaction data with Stash. This does not seem to be tied to any kind of malicious marketing tactic (at least not currently) but it is always possible that this will change.

How much stock are we talking about? According to Stash’s terms & conditions for the program, users will earn 0.125% stock back on all purchases made with the Stash Debit Card. This means that the more you use your card, the more you’ll earn. That being said, be careful not to just spend all of your money with the hope of getting rich off of earning stock back. Investing $100 into your portfolio will, of course, be wiser than spending $100 and getting just 0.125% of that invested back.

Below, you can see a few examples of stock that I earned by shopping with my Stash Debit Card while in New York City over the weekend:

While a few pennies here and there might not look too impressive, it is important to note that this was a single weekend’s worth of spending. Over time, it’s easy to see how this can start to add up over the course of a year or years—especially as the investments themselves begin to grow in value. Compared to earning nothing back at all, this feels like a steal.

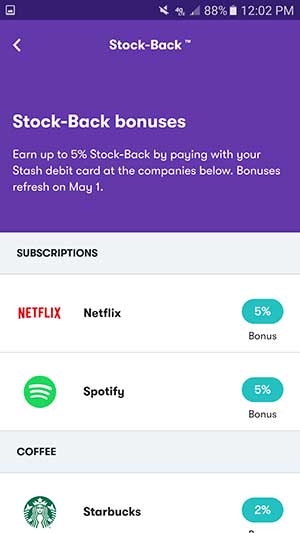

In the stock-back section of the app, you’ll also see an option to “View this month’s bonuses.” Clicking on this button will bring you to a new screen that lists specific companies that are offering a stock-back bonus through Stash. This seems to be similar to Acorns’ Found Money Program: Companies that wish to participate offer Stash users a higher payout in exchange for making a purchase. As you can see, these bonuses can range from 1% to a maximum of 5% of your purchase.

Bonuses seem to rotate every couple of months, meaning that there are likely to be plenty of opportunities to earn some nice stock-back bonuses. When the program was launched in March of 2019, the initial companies partnering with Stash to offer stock-back bonuses were Netflix, Spotify, Starbucks, and Dunkin Donuts.

Stash Learn

Stash Learn is the knowledge center that Stash uses to help educate its users. Think of it sort of like a financial blog that lives on the web but also within the app so that you always have the information that you need to make an informed decision about your finances.

Within Stash Learn, you’ll find a number of different kinds of information, including:

- A Quick Guide to get you off on the right foot using Stash

- Details about individual investment Themes that you might be considering

- Articles about general personal finance that you can use to make sure you’re being smart with your money

All in all, it’s a great resource on its own. Paired with the app, it becomes an information powerhouse.

The Bottom Line

I really enjoy using the Stash investment app and think that you might too. It’s great for college students and newbie/beginner investors for a number of reasons, but the top ones are:

- You don’t need to have hundreds or thousands of dollars to get started. It takes just $5 to open an account and begin investing.

- The app’s “Auto-stash” feature makes it easy to automate your investing so that you can begin growing your portfolio over time, without needing to think about it.

- The first month is free, so you can try it out and see if it’s something you like before you get charged.

- If you sign up through a referral link (like mine here!) you’ll get $5 that you can use to save or invest. Not groundbreaking, but better than nothing!

- It’s cheap to use, with a basic investment account costing just $1 per month regardless of how large your balance grows.

- You can either invest in pre-made portfolios that are diversified based on your financial goals and risk tolerance. This is especially helpful for beginners or those who don’t want to go through the hassle of making individual investment decisions on their own.

- If you want to be more hands on, you can be: By buying from individual stock “themes,” you can build a custom portfolio that more closely align to your interests and personal values.

- Stash Retire is an inexpensive way to begin investing in an IRA for retirement.

- The Stash Banking debit program has a lot of promise to make users smarter shoppers, while also helping you find cash back deals that you can use to grow your investment portfolio.

- Through Stash Learn, you can learn more about the world of investing so that you can become more confident in your ability to make the right financial decisions.

If you’ve been wanting to start investing but don’t know where to start, Stash is a great place to begin, and an app that I personally use and recommend.

Ultimately though, the most important thing is that you just get started. Whether that means using Stash or an alternative like Acorns or Betterment or Robinhood doesn’t really matter as long as you start now and get your money working for you!