This post may include affiliate links. Please read the disclosure at the bottom of our “About” page to learn more about our affiliate program.

According to Bankrate.com, the average savings account in the United States pays out a measly 0.06% interest (as of January 2022). With that in mind, it’s understandable that a bank that offers interest payments as high as 4% would start to grab your attention.

And that’s exactly what Current is doing.

On January 13, 2022, Current announced that members can now earn 4% interest on the money they hold in their Current Bank savings accounts. Members with a Basic (free) plan can earn 4% interest on up to $2,000 a year, while those with a Premium ($4.99/month) plan can earn 4% interest on up to $6,000 per year.

But does that make opening a Current Bank account a good idea? What benefits come with signing up for an account, and how exactly do you get started with Current? Below, we answer these and other questions about Current Bank so that you will be able to make a more informed decision about whether or not it’s the right bank for you.

What is Current Bank?

Current is a financial technology (fintech) company that provides digital banking services and benefits to its members. Current is sometimes called a “neobank” which more or less means “new bank.”

Technically, Current in and of itself is not a bank, but works with banking partners: Choice Financial Group and Metropolitan Commercial Bank. This means that if you open a Current account and hold any money in it, you’ll have the same protections and security as you would from any other bank (including FDIC insurance).

Current offers its members the ability to save and spend money, just like any other bank does. It also offers a number of unique benefits and features. Two of the most unique of these features are its Savings Pod function and its high interest rate.

Current Bank Savings Pods

Savings Pods are Current’s version of savings accounts. They are designed to help users save for specific goals, like building an emergency fund, saving up for vacation, etc. To make this clear, you can even name each Savings Pod so that you know exactly how much money you have saved for each goal.

You can deposit money directly into your Savings Pod. You can also enable “round-ups” so that when you make a purchase with your Current card, it will round the purchase up to the nearest dollar and deposit the extra money into your pod. This is a great way of passively saving for a goal without needing to actively think about it.

Current’s Basic (free) account comes with access to one Saving Pod, while the Premium (paid) account comes with access to three Savings Pods.

Current Bank Interest Rates

On January 13, 2022 Current announced that it would begin paying a 4% APY interest rate on funds that users hold in their accounts. Members with a Basic (free) account earn 4% interest on up to $2,000 per year, while members with a Premium (paid) account earn 4% interest on up to $6,000 per year. The company states that this is approximately 60 times the national average.

Another key difference between Current and other banks: Current pays interest daily, instead of monthly.

As of right now, current states that it does not view this as a promotional rate or something that will become a paid offering down the line. In an interview with TechCrunch, Current’s VP of Product, Josh Stephens said:

“We’re not approaching this as a promotional rate. We’re approaching it as something that’s available for all for the foreseeable future…I think, certainly, you see promotional rates from other folks out there with a lot of bells and whistles attached to it. But this is something that’s available for anyone, with no balance minimum, no fees.”

Current Bank Prices

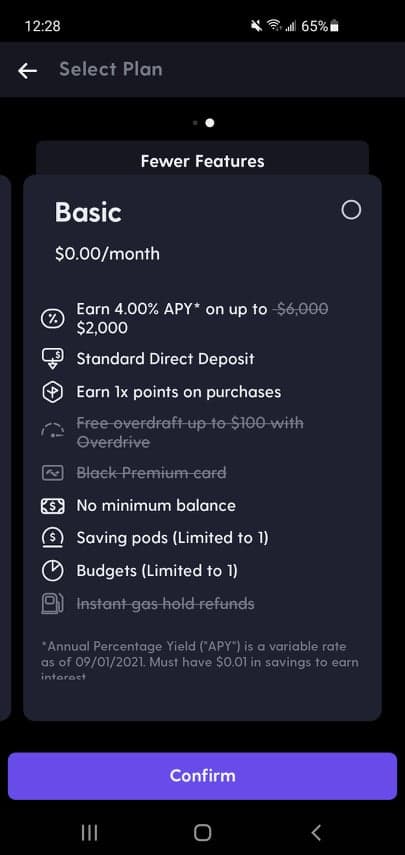

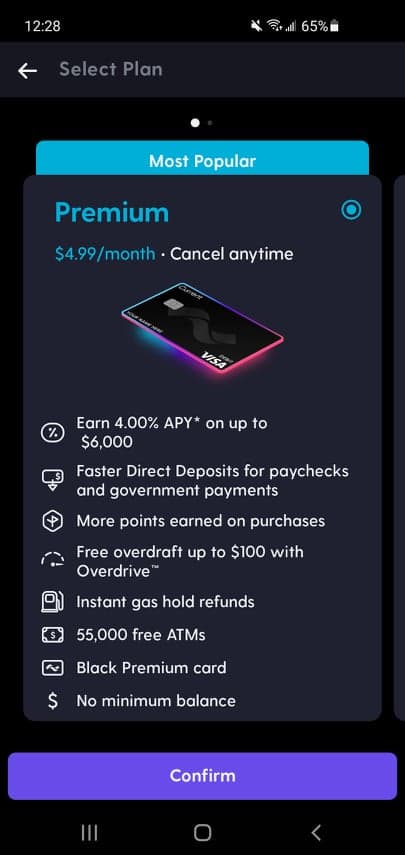

Current currently offers two payment plans, each of which comes with it’s own features.

Current Bank Basic Account Features

Current’s Basic Account is free to sign up for and use. It includes features and benefits like:

- Physical and Virtual debit cards

- Access to one “Saving Pod” where you can save for a specific purpose or goal

- Earn 4% interest on up to $2,000 in savings each year

- No minimum balance required to keep your account open

- Access to direct deposit

- Earn 1 point on all purchases you make with your Current card, which you can redeem for cash back

- Spending Insights to help you track your spending and budget

Current Bank Premium Account Features

On the other hand, Current’s Premium Account costs $4.99 per month to use, or about $60 per year. It includes everything that comes with the Basic plan, plus:

- Black Premium debit card

- Access to three “Saving Pod” where you can save for specific goals

- Earn 4% interest on up to $6,000 in savings each year

- Fee-free access to more than 55,000 ATMs nationwide

- Access to faster direct deposit for paychecks and government check

- More points earned when you make a purchase with your Current card

- Overdraft up to $100 fee-free

Current Teen Banking

In addition to the standard packages outlined above, Current also offers teen banking options that allows parents to begin teaching their children about finances. Current Teen Banking includes features like:

- Instant transfers between parent and child accounts

- Notifications on purchases your teen makes

- The ability to block merchants you don’t want your teen to be able to shop at

- The ability to set spending limits

- The ability to automate allowance payments and tie allowance to chores

- And more

Current’s Teen Banking option costs $3 per month, or $36 per year.

Opening a Current Bank Account

Opening a Current account is easy, and can be done in as little as 5 minutes. All you need to do is:

- Download the Current app by either visiting the company’s website or by searching for it on the Apple Store or Google Store.

- Enter your phone number and email address. You’ll receive a verification code to each of those that will let you proceed.

- Enter your name, birthday, and address.

- Enter your Social Security Number (don’t worry, this is not a credit check and will not impact your credit score in any way. It’s just a legal requirement.)

- Choose either a personal account or teen banking account.

- Select either a Basic or Premium plan.

- And that’s it!

You’ll receive a physical Current checking card by mail within 1 to 2 weeks. In the meantime, you can verify your digital card to begin using it almost immediately.

Next, you’ll need to fund your account. You can do this by setting up direct deposit, or by connecting an external bank account to your Current account. All you need is your account number and bank’s routing number, which you can find easily on your physical checks (if you have a checkbook).

Is Current Bank safe and legit?

Yes, Current is definitely a legitimate company, and you can feel confident that your money will be well protected if you choose to open a Current account.

The company’s banking services are provided by Choice Financial Group and Metropolitan Commercial Bank, each of which are members of the FDIC. This means that you can hold up to $250,000 in your Current account and know that you’re fully protected.

Current also includes a number of powerful security features, like:

- The ability to pause and resume transactions, which you might want to do if you lose or misplace your card

- Secure connections between your Current account and other banks

- An EMV-chip embedded in your card to ensure your information can’t be stolen by skimmers or scammers.

- The ability to lock your account with fingerprint or facial ID.

The Bottom Line: Is Current Bank worth it?

If you’re looking for a high-interest savings account that offers you the chance to grow your money while keeping it safe, then opening a Current Bank account could be a great option for you to consider.

The Basic Account is free to use, and allows you to earn 4% interest on up to $2,000 per year, which translates into earnings of up to $80. With the Premium plan, you pay $4.99 per month, or about $60 per year, which allows you to earn 4% interest on up to $6,000 per year. That’s $240. Even after factoring in the $60 yearly membership fee, you’re up more than $180 a year if you max out your accounts.

I personally have a Basic Current account, which I intend to max out with $2,000 in savings. Since this is separate from my regular account, I view it as a mini emergency fund that will allow my money to grow in a way that it can’t at my other bank.

My bottom line: I think it’s worth it.