This post may include affiliate links. Please read the disclosure at the bottom of our “About” page to learn more about our affiliate program.

Recently, Acorns announced a new type of account—designed specifically for users who would like to begin investing for their children—called Acorns Early.

Below, we take a look at what exactly Acorns Early is, how it works, and what you need to know before opening an Acorns Early account for your child.

What is Acorns Early?

Acorns Early is a new type of account offered by the Acorns Investment App. While minors are unable to invest their own money, Acorns Early is designed to give parents and families a way to begin investing for their child’s future.

Specifically, Acorns Early is considered a type of custodial account under the Uniform Gift to Minors Act or Uniform Transfers to Minors Act. These laws allow a custodian (often a parent, grandparent, relative, or other adult) to open an account for a minor beneficiary (often a child).

Once the beneficiary meets the “age of majority” (i.e., becomes an adult) then they can take control of the account. Most often, this is between the age of 18 and 25, but that depends on the state where you live.

How does Acorns Early work?

Acorns Early allows you to open an investment account for any child in your life. This can include your own children, your grandchildren, nieces/nephews, siblings, the child of a friend, etc. By starting early—much earlier than a child could start to invest on their own—you give the money that much more time to grow.

Once the beneficiary reaches the age in which they can take control over the account, they can use that money for whatever they wish. Some of these uses might include:

- Saving a down payment for a home

- Paying for a wedding

- Taking an extended vacation

- Getting a jump start on building wealth

- Paying for college (though there are other types of accounts that are typically better suited for this)

Acorns Early Portfolios

As with all of the accounts offered by Acorns, funds held in an Acorns Early account are invested into a portfolio consisting of exchange-traded funds (ETFs) which offer instant diversification.

According to Acorns, all funds invested in an Acorns Early account are invested into the Aggressive Portfolio, which consists entirely of stocks:

- 40% in Large Caps

- 20% in Small Caps

- 20% in Developed Markets

- 10% in Emerging Markets

- 10% in REITs

Why is Acorns Early invested so aggressively? Because the beneficiary is young, they naturally have more time in their investment horizon—the time before they will need to access the money. This means that they can comfortably take on more risk, and receive more reward, compared to investors with shorter investment horizons.

How much does Acorns Early Cost?

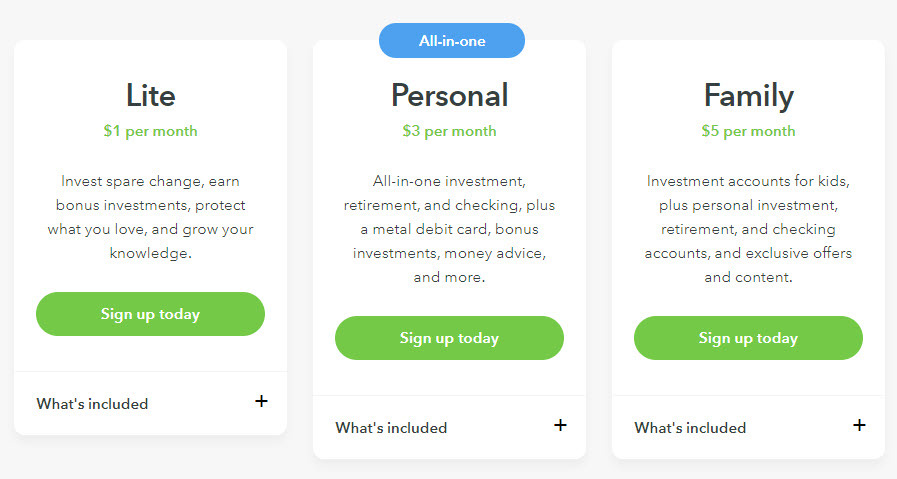

In order to open an Acorns Early account, you will need to open a Family Plan through the Acorns app. This plan costs $5 per month, and includes:

- A regular Acorns Invest account

- An Acorns Later retirement account

- An Acorns Spend checking account

- Access to open multiple Acorns Early accounts

You can see all of Acorns’ pricing tiers here.

Is Acorns Early a 529 college saving plan?

Short answer: No.

529 college savings plans are special types of investment accounts that parents and adults can use to begin saving for a child’s educational expenses. They come with some pretty powerful benefits, including tax benefits, which an Acorns Early account does not carry.

Because an Acorns Early account is not a 529, once the beneficiary is of age, they can use the funds for whatever they want: It isn’t limited to just paying for college expenses.

If you are primarily looking for a way to begin saving for your child’s future college expenses, you should prioritize a 529 in my opinion. Still, opening an Acorns Early account can be a great way of helping your child begin saving for other expenses that they will inevitably incur as an adult.

How to Sign Up for Acorns Early

Opening an Acorns Early account is very simple. According to Acorns, it can be completed in as little as three minutes. All you need to do it:

- Open an Acorns account, if you don’t yet have one.

- Once you have set up your own profile, navigate to the “Early” option on the app’s home screen.

- Enter the necessary information, including the child’s name, their date of birth, and their Social Security Number.

- You can then begin investing immediately, with as little as $5.

As with Acorns Invest and Acorns Later, you can contribute to your Acorns Early account by making one-time investments or by setting up a recurring investment.

Opening an Acorns Early Account for Multiple Children

Do you have more than one child that you want to begin investing for? You can open an Acorns Early account for each of them. You do not pay an extra fee for opening multiple Acorns Early accounts.

All you need to do, after you’ve opened your first Acorns Early account, is navigate back to the “Early for Kids” screen and click “Add a Child.” You will then need to enter all of the same—name, date of birth Social Security Number—information for that child.

Can you open an Acorns Early account for a child who isn’t yours?

Yes! You can open an Acorns Early account for any child who you want to begin investing for. This can be your own child, a grandchild, a niece or nephew, the child of a friend, a sponsor—the list really does go on.

All you need is the child’s name, their date of birth, and their Social Security Number.

That being said, if you are considering opening an account for a child that is not your child, be sure that you are communicating with the child’s parents about your plan. The existence of a custodial account can impact a child’s future financial aid eligibility, so it’s important for the parents to know what’s happening.

The Bottom Line

If you want to begin investing for a child that you love and care about, then opening an Acorns Early account is an easy, inexpensive way of doing just that.

For $5 a month, you gain the ability to open custodial accounts for multiple children, where money can grow and be used in the future. In addition to that, you gain access to Acorns Invest, Acorns Later, and Acorns Spend—the full fleet of Acorns financial products.

I am personally using Acorns Early to invest for a child that I care about, and love the experience so far. I can only imagine the service will improve as time goes on.

Want to give it a shot? Sign up for Acorns today.