Whether you’re just about to enroll in college, you’re about to graduate, or you’re a fresh grad starting out in post-college life, there’s a pretty good chance that someone, somewhere, has taken it upon themselves to give you unsolicited financial advice. And no matter who that person is, their list almost certainly included something along the lines of: Pay attention to your credit score!

It might be annoying to keep hearing the same thing from your parents, friends, aunts, uncles, cousins, grocer, and mailperson, but the truth is that it’s very good advice. Simply put, your credit score is an incredibly important number, with the ability to impact almost every part of your life.

Scared? Don’t be. All of this isn’t meant to freak you out. It’s just meant to help you understand that credit is important.

If you’re ready to start taking your credit seriously, the guide below is a great place to start. It’ll teach you everything you need to know about what credit is, what a good credit score looks like, how you can check your score, what impacts your score, and more.

1. What is credit?

Simply put, credit is money that you borrow from a lender (or creditor) in order to purchase goods or services.

There are four main types of credit:

- Revolving Credit: With revolving credit, you have a maximum credit limit, and you’re able to make purchases (or charges) up to that amount. Each month, you’ll be expected to make a minimum monthly payment on the purchases that you made. If you are unable to pay the balance off in full, it will carry over (or revolve) to the next month, and you’ll be expected to pay interest on top of the balance. Credit cards are a great example of revolving credit.

- Installment Credit: With installment credit, your lender gives you a specific amount of money upfront. You are then expected to make payments according to a specified installment schedule (for example, each month). These payments will be used to pay down the principle as well as any interest that the debt has accrued. Your student loans or mortgage payments are an example of installment credit.

- Service Credit: With service credit, you are supplied a service or utility and will be expected to make payments at a later date. Your electricity bill, water bill, phone bill, or gym membership are all examples of service credit.

- Charge Cards: Charge cards (or charge accounts) are similar to credit cards and revolving credit, and are often used in the same way, but they differ in one key area: The balance on a charge account must be paid in full each month.

Your credit score, on the other hand, is a number that is calculated by credit reporting agencies in order to estimate your creditworthiness, or your ability to repay a debt. If you have a lower credit score, it means that you’re seen as a riskier borrower who may not be able to pay back a debt; if you have a higher credit score, it means that you are seen as less risky.

2. What are good and bad credit score?

What exactly counts as a good or bad credit score will depend on which scoring model is calculating your score, and which credit reporting agency is reporting your score.

In the US, the two largest credit scoring models, by far, are the FICO score and VantageScore. Of the two, the FICO score is the one that lenders use most often to evaluate borrowers. Each of these scores uses the same factors (as you’ll see below) to calculate a score, but do so in slightly different ways. Because of this, your FICO score and your VantageScore will often be close to each other, but slightly different.

FICO and VantageScore also define their credit ranges in slightly different ways, as the chart below shows:

| Poor | Fair | Good | Very Good | Excellent | |

| VantageScore | 300-600 | 601-660 | 661-780 | N/A | 781-850 |

| FICO | 300-579 | 580-669 | 670-739 | 740-799 | 800-850 |

Often, in order to account for both scoring models, people will define scores according to the ranges below:

- Poor: 300 to mid-600s

- Fair to Good: mid-600s to mid-700s

- Very Good to Excellent: Anything higher than 750

Because the same number might put you in different score ranges depending on which scoring model is being used, it’s a good idea to know both your FICO and VantageScore.

3. Where can you check your credit scores?

In the US, there are three major credit bureaus—Experian, Equifax, and TransUnion—who collect and report credit data. By federal law, you’re entitled to get one free copy of your full credit report each year from each of these agencies. You can do so by going to AnnualCreditReport.com.

Sometimes, you might find that you don’t have exactly the same credit score

While its a good idea for you to get and review your full report each year from each agency, processing the requests does take time. If you want to know your scores more quickly, there are other places you can turn:

- Your bank or credit card company: Many banks and lenders have begun to include credit scores in their client portals or monthly statements.

- An online company: Many online companies now offer the ability to quickly check your credit score. CreditKarma, Credit.com, and Credit Sesame are all examples that offer free score checks. (I personally use CreditKarma, and enjoy them.)

4. How often should you check your credit score?

Just like you shouldn’t check your investment balance daily, you also don’t want to obsess over your credit score.

That being said, you do want to make sure that you understand what’s going on with your credit report and score. Not only will it help you understand the impact of the progress you’re making as you pay down your loans, etc., but it will also help you spot fraudulent activity, like someone opening an account in your name.

At a minimum, you should check your credit score and report once a year or every six months so that you can make sure everything looks right. I personally check my report annually and my score on a monthly basis so that I can spot check for inaccuracies and make sure that my identity is secure.

5. Does checking your credit score hurt the score?

Simply put: No, personally checking your own credit score won’t impact your credit score in any way. (Whether you’re requesting your full credit report or by using a site like CreditKarma doesn’t typically matter.) That’s because there are two kinds of credit inquiries: Soft checks, and hard checks.

A soft check (also called a soft pull or a soft inquiry) doesn’t affect your credit score because it’s not tied to a specific application for credit. It doesn’t necessarily imply that you’re actively looking for credit, only that you are curious about your credit score. In addition to you checking your own credit score, other examples of soft checks might include when a company or lender pre-approves you for an offer, or when you use a comparison service to give you estimated interest rates on a loan.

A hard check (also called a hard pull or hard inquiry) on the other hand does have the potential to impact your credit score. A hard check only happens when you actively apply for credit (whether a credit card, student loan, auto loan, personal loan, or mortgage) and the lender requests your credit report to determine whether or not you are creditworthy. The reason? Multiple hard checks may imply that you’re opening a number of new accounts, which could signal to lenders that you are taking on more credit than you can pay back.

6. What impacts your credit score?

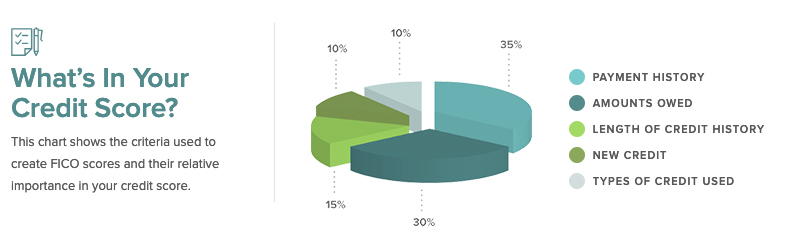

There are five main factors that impact your credit score:

- Payment History: Payment history—whether or not you consistently pay your bills on time—accounts for around 35 percent of your credit score.

- Level of Debt: Your level of debt accounts for around 30 percent of your credit score. This includes both the total amount of money that you owe, as well as your credit utilization ratio.

- Length of Credit History: The age of your credit history accounts for around 15 percent of your credit score, and helps borrowers understand if and how your habits have changed over time. Having a longer credit history implies that you know how to handle credit responsibly.

- Types of Credit: The different types of credit that you currently have account for around 10 percent of your credit score. Your ratio of revolving credit (bad) to service and installment credit (good) are taken into account.

- New Credit Applications: As mentioned above, the number of new credit applications (or hard checks) in your report accounts for around 10 percent of your credit score.

As you can see, of all of these factors, your payment history and your credit utilization rate are the two most important factors, together accounting for more than half of your credit score. Luckily, they are both the factors which are most in your control.

“Most other factors that impact your credit score and report involve considerations outside of your control. For example, the length of your credit history is limited by time: There’s no way to speed up the clock,” says Nathan Grant, a credit industry analyst over at Credit Card Insider. “But your payment history and the amount of debt you carry are fully within your control.”

That being said, there are ways that you can improve some of these other factors that are seemingly out of your control. For example, if you pay off your credit card and have the willpower not to fall back into debt, Grant recommends that you keep the card open to keep your credit history active and your utilization rate low.

Why You Should Care

Like we mentioned above, your credit score is an important number that can have a major impact on your life. Your credit score can determine:

- Whether or not you’ll be approved for loans like car loans, student loans, personal loans, credit cards, and a mortgage

- The interest rates you’ll be charged on those loans

- Whether or not you will be approved to rent an apartment, house, or car

- Whether or not a utility company (electricity, water, phone) chooses to do business with you

- Whether or not you are hired for certain jobs

- And more

That’s why it’s so important that you take your credit seriously, always know what’s in your reports, and take the right steps to improving and protecting your score.